The normalization of hybrid work has completely shifted the way most employers think about office space and plan for growth. According to Gartner, more than 80 percent of organizations have continued some form of hybrid work in the post-COVID economy.

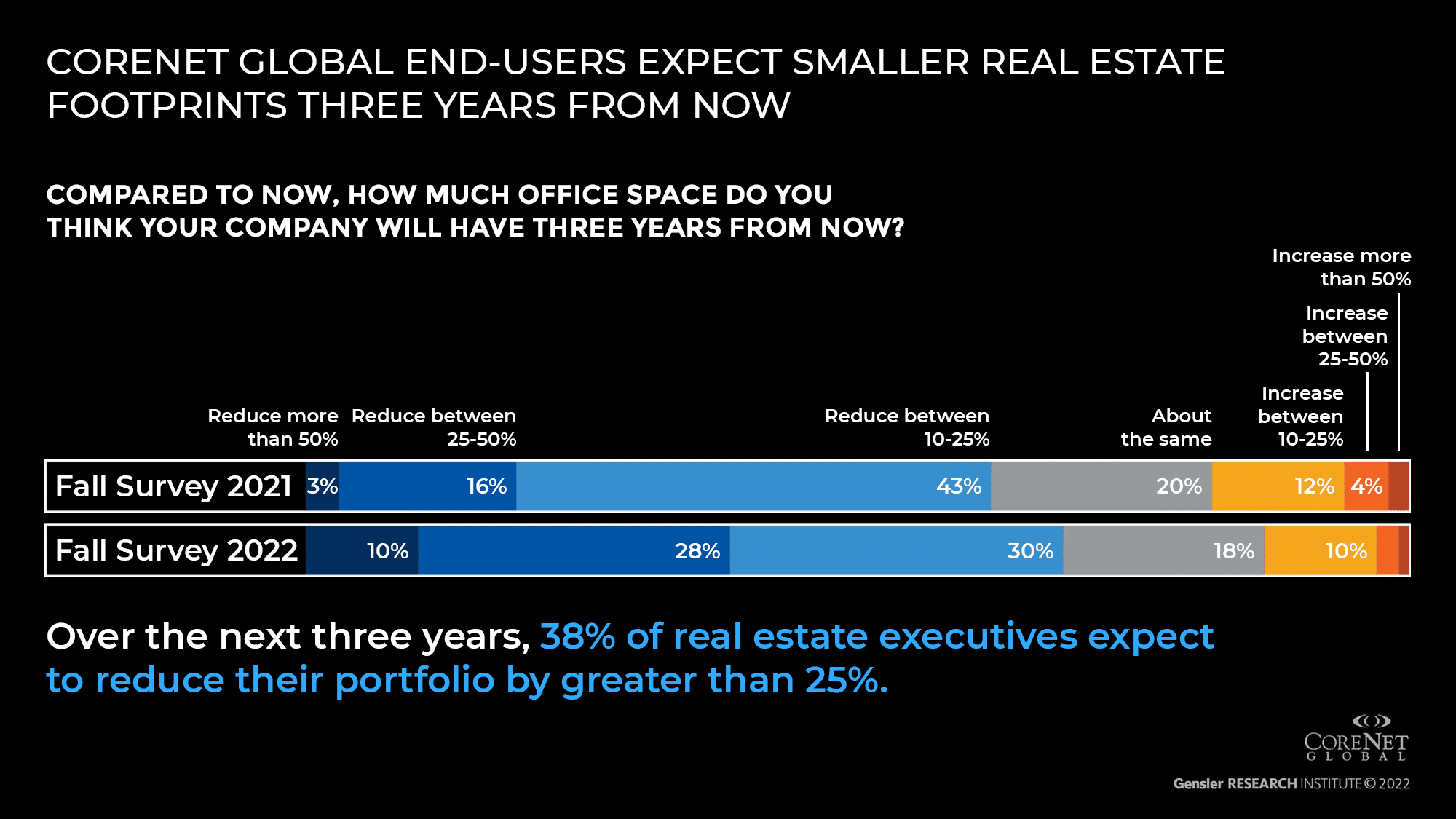

Gone are the days of long-term leases and oversized offices—today’s enterprises strive for agility, leveraging flexible leases and remote work to “right size” their portfolios and consolidate their corporate real estate. In fact, CoreNet Global claims more than two thirds of real estate executives expect to reduce their portfolio by at least 10 percent over the next three years.

Whether it happens through subletting, relocating, exiting leases, or implementing a hybrid model, for enterprises, this reduction in office space represents millions of dollars in annual savings on operating expenses.

But while the benefits of optimizing your corporate real estate have become more clear and more widely embraced in recent years, the path forward can be incredibly challenging. Whatever your goals, there are multiple strategies you can use to reach them. Moving forward with the wrong strategy could leave you scrambling to find more square footage or paying for space you don’t need. And even with a solid plan in place, it’s difficult to accurately gauge an opportunity’s potential—or recognize when there’s a better option.

That’s why we created Tango Portfolio Strategy. After more than two decades select the best sites, analyze the impact of their real estate decisions, and execute their location strategies, we’ve built a solution that addresses the unique real estate challenges of modern enterprises. Combining GIS mapping, scenario planning, site modeling, space planning, and predictive analytics, Portfolio Strategy gives you the tools you need to test, validate, plan, and execute real estate decisions that meet and exceed your goals.

In this article, we’ll walk you through how Tango Portfolio Strategy enables you to:

- Organize your data

- Visualize your locations

- Explore your possibilities

- Execute your location strategy

Let’s start with the information that forms the backbone of Portfolio Strategy’s capabilities.

Organize your data

Tango Portfolio Strategy is more than a planning tool. It utilizes your current real estate data—costs, space, lease dates, occupancy, etc.—to predict outcomes based on your business’ actual reality.

Not all of these data points are numeric. For example, we make a point of clarifying each location’s relative importance—if there’s a building you’d never get rid of (such as your headquarters, or a legacy datacenter that’s too costly to move), that information is brought into the system and informs all future predictions

Portfolio Strategy also incorporates what we call “strategy data,” or “tactic data.” This includes all of the changes you would consider making with a given building, such as closing the building, starting a new lease, renewing a lease, adding neighborhood flex areas or another hybrid model to increase capacity, or subleasing. This provides some guardrails for future scenarios and ensures you’ll only see the possibilities that fit your strategy.

Whatever your objective, your real estate options are limited or guided by the terms of your lease, contract type, rentable square footage, capacity (i.e. number of seats), cost per square foot, cost per workstation, move rate per person per floor, move rate per person per building, etc. Portfolio Strategy utilizes all of this information and anything else that’s important to consider as you weigh your options and compare locations—such as annual operating costs, including utilities and any other costs associated with your use of the building. For each location, you can also break this information down by sublease as well.

There’s optional data that can be useful, too. Providing your employees’ nine digit zip codes, for example, will enable you to consider each building in relation to the general area each employee lives (Tango doesn’t use home addresses to retain employee privacy). This helps you get a fuller picture of the impact each decision could have on your business, including potential increases in turnover, changes in employee sentiment, or an influx of requests for greater compensation.

Some building information will have to be manually entered for each location, such as your strategy data. But for everything else, you can also import it from spreadsheets in Excel and other programs (like your space management software). If this is information you update frequently, you can also create integrations to update it automatically as the data is available. When you’re dealing with millions of square feet and numerous buildings, streamlining these preliminary steps will save substantial time now, and later.

Since 2020, many large corporations have taken a “let’s wait and see” approach to their real estate portfolios. But once you have all the necessary data in Tango Portfolio Strategy, you can say, “let’s take a look” instead.

Visualize your locations

Retailers have been using Tango’s GIS mapping capabilities for years. Now, corporations with multiple offices can use these same geographic information systems to put their current and potential office buildings on the map.

You can use filters to visually explore your portfolio with color-coded indicators of when leases are set to expire (less than 12 months, 12–24 months, 24+ months, etc.), as well as at-a-glance views of the types of strategies you’re using to conserve space or reduce spend, cost of operations, vacancy in each building or floor, and more.

Using employee zip code extensions, you can even filter buildings by drive time from the neighborhoods where employees live. For example, if you’re considering where to relocate an office or open a new one to accommodate changes to the population of a specific building, you might want to see all the potential offices within a 30-minute drive of the employees who work in the current office.

Seeing your portfolio on a map can yield new insights into your available options, how well your buildings fit your employees, and how various moves could impact your business. And these visual tools become all the more valuable when you begin exploring specific strategies.

Explore your real estate possibilities

Optimizing your corporate real estate often starts with a question. “How do we reduce our total real estate footprint by 10%? Or 40%?” Perhaps you’re more interested in cutting your costs by a dollar value or a percentage. Or maybe you want to know which locations you could get rid of, and how each decision would affect your portfolio.

There are many different ways to answer these questions, and Tango Portfolio Strategy lets you see and compare all the possibilities—whether a single major move is the best solution or a series of smaller transitions spread across more of your portfolio. You can analyze which choices most efficiently reach your goals or have the highest likelihood of exceeding them, and then prioritize accordingly.

Each of these moves constitutes “a tactic” in Tango. You can have as many of these as you want for a given building, and you’ll designate whether the tactic is proposed or active. Note, however, that while you can have multiple tactics in the system for each building, you can’t have multiple active tactics that are in conflict. You can’t simultaneously exit a lease and move employees to the building from another location—in reality or in Tango. Still, you might have one tactic active for this quarter, and another active tactic scheduled to start six months from now.

For every decision, Tango provides a best case and worst case scenario to help you avoid real estate moves you’d potentially have to correct for down the road. You can see how inflation and other factors may affect what you ultimately gain.

Here are some of the real estate moves Tango can help you explore, using accurate site models to produce reliable predictions.

Exiting a lease

As you consider the best ways to downsize your portfolio, the process often starts with determining which leases are easiest to get out of. Tango helps by helping you visually represent all of the leases that expire in a given time frame, such as the next 12 months.

From here, you can zero in on a lease that’s ending soon and explore the nearest suitable offices you could move the affected employees to. Can you merge two nearby locations and only renew one? Does it have the capacity to support the employee populations of both offices? If not, you can begin testing ways to increase the number of seats or total headcount.

With your lease expirations right in front of you, it may become clear that the best route to exiting a couple of leases with high rates is to build or lease a new location. Using Tango, you can simulate these various moves to see which yields the best outcome.

Your possibilities depend on the specific clauses in your lease, but as you consider which leases to exit, Tango lets you see the actual options you have available based on your terms.

Starting a new lease

Despite the historically high vacancy rates of corporate office buildings, we’re still seeing a lot of enterprises navigating the best ways to start new leases. This is often in connection with other moves, like exiting leases, but it’s also possible to pick up great deals as other companies try to get out of their own leases.

Whether it’s in the same building as an existing lease or an entirely different facility, starting a new lease involves negotiations, potential renovations, moving employees, and more. In Tango, you can indicate whether each new lease is proposed or active, what the critical dates are, any applicable tenant improvement dollars it comes with, the number of people you’ll have to move, the total costs, and the perceived risk level.

Subleasing

Subleasing has become an increasingly popular tactic for shedding unneeded office space. Tango Portfolio Strategy helps you forecast the effect over time of potential subleases, enabling you to test and validate proposals. You can try different rates, various combinations of floors and buildings, optimizing for the square footage, costs, or capacity you plan to reduce your portfolio by.

Hybrid work

Implementing some form of hybrid work like flexible seating will change your capacity without necessarily affecting your operating costs or real estate footprint, making it a useful tactic for planning for growth, consolidating locations, or freeing up space for subleases and other moves.

You may want to use flexible seating, for example, to enable you to exit another lease in the same building or a nearby office. Implementing neighborhoods, a reservation system, or a hybrid setup of some kind could give you an additional 100 “seats” at a given location without adding workstations. Or perhaps you want to see what it would be like to roll it out across your portfolio, or in a handful of nearby locations.

In Tango, you can propose or activate plans to implement a hybrid workplace model and see how each scenario would play out, connecting them to other real estate moves if appropriate.

Execute your strategy

Enterprises don’t just make one-off real estate moves based on whims. Each move is part of a larger strategy, a specific tactic deployed to accomplish larger business goals. Tango Portfolio Strategy helps you visually explore every move, proposed and active, and group connected moves into initiatives.

For example, say you have an active plan to exit a lease in a large office building. To accommodate the employees who will be moving from this building, you’re implementing flexible seating at two nearby offices and starting a new lease at a smaller office, where you’ve already scored an excellent rate from a landlord you have other leases with. Each of these is a major move you’ll need to track separately, but they’re also connected.

As you look to your organization’s future, Tango Portfolio Strategy is your command center. It equips you to monitor your progress on individual tactics and larger initiatives and generate convenient reports that summarize where you stand, what you’re on track to accomplish, and which moves make the most sense for your short-term and long-term strategies.

Want to see what Tango Portfolio Strategy can do for your business?