2025 Enterprise Occupancy Report: Strategies, Stats & Smart Space Decisions

CONTENTS

- Most Interesting Findings

- Real Estate & Facilities Management Priorities

- Approaches to Hybrid Work

- Occupancy Tracking Adoption

- Occupancy Tracking Technology

- Occupancy Tracking Use Case Alignment

- Barriers to Occupancy Tracking Adoption

- Occupancy Tracking Maturity

- Occupancy Data Integration

- Real-time Occupancy Tracking

- Conclusion

The 2025 Enterprise Occupancy Tracking Report: Stats, Challenges, Insights

We asked: are companies finally getting occupancy right?

Occupancy monitoring—tracking the presence of people in physical space—has played a key role in space management for decades, but over the last few years, the widespread adoption of hybrid work revealed just how ill-equipped most organizations were to perform occupancy analytics and leverage the insights it yielded.

Reliance on badge scans and manual walkthroughs leaves major gaps in a company’s ability to effectively track space utilization, not all of which can be filled by even the most advanced desk booking solutions. A surge of occupancy monitoring technologies emerged to close these gaps, offering the granular real-time occupancy insights enterprises needed, but for most organizations, the cost of adoption overshadowed the potential for real-estate savings. More recently, sensorless occupancy monitoring solutions entered the fray, providing most of the data enterprises need at a fraction of the cost. But adoption remains low, and occupancy monitoring remains a challenge.

In 2025, many previously remote and hybrid workplaces have finally implemented return-to-office mandates that have been years in the making. In the wake of this return to work, some companies are questioning whether they have too much space while others are finding that they don’t have enough. Both scenarios can be resolved with better occupancy analytics—but just how equipped are large enterprises to navigate this area? We conducted a study to find out.

In the fall of 2024, we set out to investigate how enterprises currently approach occupancy monitoring and learn how equipped they are to optimize their space. We conducted an occupancy monitoring study of some of the world’s largest firms in a range of industries. Our teams collaborated to develop a questionnaire, and through a combination of qualitative and quantitative interviews at the end of 2024, asked various real estate leaders at these organizations to share about their priorities, experience, and expertise when it comes to occupancy monitoring technology.

The respondents were split between North America (US and Canada) and Europe, and represented six industry groups: finance, media and telecommunications, pharmaceutical and life sciences, manufacturing and industrial, and retail and restaurant. The firms selected all have an annual revenue of at least $1 billion USD, with 40% having annual revenue greater than $10 billion USD. Just over half of these firms (56%) primarily own and occupy their own buildings, while 44% are primarily tenants.

All respondents indicated that they “hold a substantial influence over procuring real estate technology” from a role that typically related to facilities, real estate, and/or HR functions.

The insights in this report highlight how key real estate decision makers at some of the world’s top enterprises view occupancy tracking technologies.

But first, here are some of the most interesting findings…

This study revealed a number of insights around the state of occupancy monitoring. In general, our findings indicated that organizations struggle to fully realize benefits from the occupancy data they’re already collecting. There’s significant alignment between enterprise needs and occupancy tracking use cases, but enterprises express resistance to increasing their investment in occupancy tracking technologies. We believe that these are valid concerns, and that instead of adopting more tracking technology, organizations looking to realize the benefits associated with occupancy monitoring should focus on operationalizing existing occupancy data.- Most enterprises (68%) track occupancy using at least two data sources—including 100% of firms with real-time occupancy tracking capabilities.

- No firms exclusively used sensors to track occupancy.

- Most enterprises (60%) track occupancy in less than 75% of their buildings.

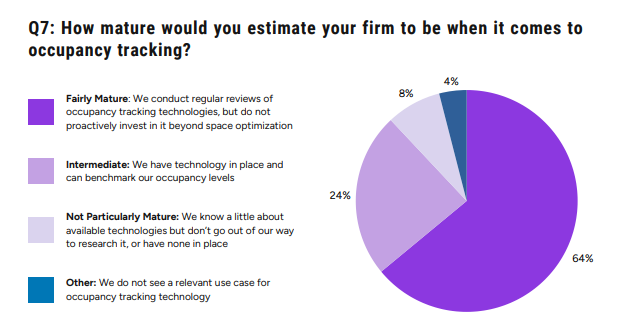

- While most firms (64%) said they were “fairly mature” when it comes to occupancy monitoring, none of them believed they were “very mature,” which meant “being up to date on the latest technologies and using occupancy tracking for use cases such as sustainability.”

- The vast majority of firms (92%) ranked cost savings as one of their top two real estate and facility management priorities, and nearly half of respondents (48%) cited initial investment costs as the most significant barrier to occupancy tracking technology.

Real Estate & Facilities Management Priorities

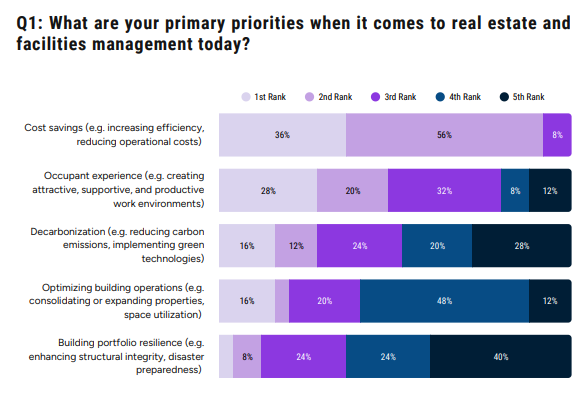

Participants were asked to share their priorities in real estate and facilities management. As one might expect, responses varied by region and industry. But in general, cost savings is the biggest priority for enterprises today.

Cost savings are the primary driver for investments in occupancy monitoring technology

The vast majority of respondents (92%) ranked “cost savings” (including things like increasing efficiency and reducing operating costs) as one of their top two priorities. Of the industries surveyed, pharmaceutical companies were most likely to prioritize cost savings, with 80% ranking it as their top priority.

Real estate usually represents one of an organization’s greatest operating expenses. Occupancy monitoring can lead to cost savings in this area by revealing precisely where an organization has excess space and how much of it they have, so real estate stakeholders can decide whether to downsize or sublet to avoid paying for space they don’t need (as their lease terms allow). Alternatively, excess space can be repurposed, which doesn’t reduce costs outright, but can prevent the business from needlessly acquiring additional space. Occupancy monitoring also supports an enterprise’s ability to improve efficiency and lower costs through infrastructure optimizations (lighting, heating, air conditioning, etc.).

But the question is, how much of these savings opportunities can be achieved without major investments in occupancy monitoring technology—especially new hardware that requires maintenance? For some hybrid workplaces, reservation data and badge scans provide a pretty accurate picture of a building’s occupancy. And in the right situations, that information may be all that’s needed to effectively allocate and optimize space.

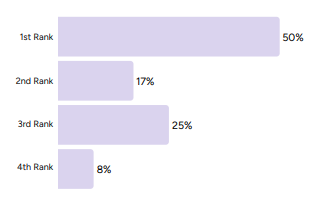

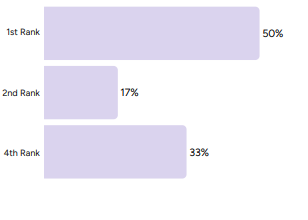

North American firms prioritized occupant experience

50% of North American firms ranked “occupant experience” (defined as “creating attractive, supportive, and productive work environments”) as their number one real estate and facilities management priority, and 25% ranked it as their second highest priority. In contrast, only 8% of European firms considered occupant experience their top priority, and 23% considered it their second highest priority.

Occupant experience is another area where occupancy tracking technology can provide value, but the level of granularity required depends on the organization and situation. Desk booking solutions can show stakeholders which reservable spaces are most popular and make decisions to ensure there’s enough supply of these spaces, or help direct employees to other spaces and times with lower utilization rates. Badge scan data may help them see the impact of decisions and improvements on broader occupancy patterns. But these solutions lack the ability to track permanently assigned spaces and non-reservable spaces.

They can’t detect overcrowded commons areas, or help you recognize when a shared lounge space is everyone’s favorite informal meeting spot—or when it’s severely underutilized.

Depending on how you intend to improve the occupant experience, badge scan and reservation data may be a sufficient indicator of occupant satisfaction, but if you’re not tracking assigned and non-reservable spaces, you’ll be reliant on feedback from occupants like employee surveys, which don’t always match occupant behavior.

Manufacturing firms care most about optimizing building operations

Perhaps unsurprisingly, real estate stakeholders at manufacturing and industrial firms were most concerned with optimizing building operations, with half of them ranking it as their number one priority. Consolidating or expanding properties and improving space utilization is also one of the top use cases for occupancy tracking: manufacturers can use it to reveal where there’s capacity for more production, as well as instances where over utilization may be interfering with efficiency.

Notably, manufacturing and industrial firms were significantly less concerned with improving the occupant experience. The highest any manufacturing or industrial firm ranked this consideration was 3. 23% considered it their second highest priority.

Approaches to Hybrid Work

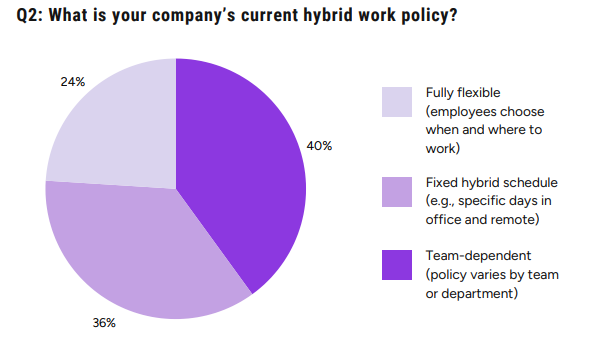

The survey asked respondents to share their current hybrid work policy, selecting the best fit from three options:- Fully flexible (employees choose when and where to work)

- Fixed-hybrid schedule (e.g. specific days in office and remote)

- Team-dependent (policy varies by team or department)

40% of enterprises have different hybrid policies for different teams and departments

Some roles simply aren’t suited for hybrid or remote work. They may require specialized equipment or particular environments, or be heavily dependent on constant synchronous collaboration. In these instances, it’s common for some roles or departments to have different WFH policies than others. Often, this means that employees will have varying levels of flexibility. For an organization, that means some demand for space will be consistent (based on the percentage of employees required to work in-person), and some will also vary based on hybrid schedules.

This can complicate efforts to track space utilization throughout the building. How does the influx of hybrid employees affect congestion, shared spaces, and amenities? Is it more difficult for fully in-person employees to work effectively and access the resources they need on days where there are more hybrid employees in the building? Badge scans rarely provide sufficient insight. Reservation and sensor data is also needed to show variations in utilization rates for reservable and non-reservable spaces.

Smaller enterprises offer more flexibility

Giving employees complete autonomy to decide where, when, and how they work is obviously the most difficult hybrid work policy to facilitate. On any given day, demand for space depends on the overlap in employees’ personal schedules and preferences. A fixed schedule, alternatively, allows an employer to coordinate who is in the office on which days and at what times, making it easier to balance demand for space throughout the week.

Considering these added challenges, it’s not surprising that only about one quarter (24%) of all firms surveyed let employees choose where and how they work. However, when the survey data was isolated to “smaller” firms (those with between $1 billion and $10 billion in annual revenue), the percentage increased to one third.

In our 2025 Workplace Predictions, Tango’s workplace experts argued that smaller businesses will be best positioned to offer greater flexibility, and that they’ll need this advantage to compete with larger enterprises with more compelling compensation packages. Andy Anderson, our EVP of Energy and Sustainability, noted that “with every new RTO mandate that comes into effect in 2025, leaner SMBs can swoop in to offer one of the most desirable benefits to modern office workers.”

Regardless of company size, fully flexible hybrid policies make real-time occupancy management far more critical. With less influence over how employees use your space, it’s more important to react to utilization and reallocate space in response to demand.

Even if you aren’t trying to constantly fine-tune your office configuration, advanced occupancy monitoring technology like sensors and network-based tracking may be necessary to help employees find more of the space they need and enable you to react to daily demand. For example, on a day when the building has peak occupancy, you may want to temporarily repurpose underutilized common areas as extra overflow workspaces or meeting areas. Or if certain shared spaces are overutilized, you could identify similar spaces and encourage employees to use them at peak times. The more precise your utilization data, the better equipped you are to react to the demands of real-time occupancy.

30% of firms experienced challenges with hybrid work

All 25 firms in this survey were using a hybrid model, and while most respondents felt they had strong support from leadership, 30% had encountered some challenges or frustrations, including:

- Occupancy challenges brought on by too many employees working remotely on Fridays

- Maintaining teamwork and collaboration when some team members are remote

- Being inclusive and ensuring all perspectives are heard

- Accurately tracking occupancy

- Balancing in-person and remote work

- Equipping employees with the necessary technology

- Keeping remote work as secure as on-site work

- Having to meet on Zoom all day even when working from the office

Several of these challenges are simply part of the inherent trade-off between hybrid and fully in-person work models. Some need to be addressed through company policy. But others can be resolved or mitigated through better occupancy management, which stems from a company’s occupancy tracking capabilities.

For example, if in-person workers have to meet with colleagues via video conferencing, it suggests that there needs to be better coordination around working in the office. While it’s not always possible for people to coordinate time in the office, advanced reservation systems like Tango Reserve let employees share their schedules with trusted colleagues. When one of these colleagues goes to reserve a space in the office, the system can then recommend when and where they reserve space based on their team members’ planned time in the office.

Occupancy Tracking Adoption

While sensor vendors may push companies to track every inch or centimeter of every office, enterprises are trying to strike the right balance between collecting enough data to make informed decisions and keeping occupancy tracking costs low. They’re asking, “How much data is enough?” Respondents shared the extent to which they track occupancy across their real estate portfolios, expressed as a percentage. For the purposes of this question, any form of occupancy tracking counted as coverage.

60% of firms have a significant gap in occupancy monitoring coverage

Most enterprises aren’t tracking occupancy in at least one out of every four buildings. And no firms had 100% coverage. These are companies generating a minimum of $1 billion USD in annual revenue, with 40% generating upwards of $10 billion USD. So these aren’t small real estate portfolios. These gaps could represent dozens, hundreds, or even thousands of untracked buildings.

Is this lack of visibility a problem?

A follow-up question asked respondents to explain their rationale for not having 100% coverage, and their response included reasons like:

- Tracking every building was too expensive

- The untracked locations had very few people

- The untracked buildings were for specialized uses, were utilized infrequently, or simply didn’t need to be tracked

- The organization prioritized the buildings that were most crucial to their operations

- They could obtain the data if needed

- Tracking every building would produce an overwhelming amount of data

Every business may have a different, reasonable answer to the question of “how much occupancy data do we need?” But whatever the reason, occupancy tracking isn’t driving real estate decisions for these untracked buildings, and that makes it impossible to optimize their costs, efficiency, or occupant satisfaction.

By far, the most common explanation was that tracking the entire portfolio was simply too expensive. More than one third (37.5%) of respondents cited costs in their rationale for not tracking occupancy in all buildings. If the cost of occupancy tracking were lower, or they were aware of a more affordable solution, they’d likely increase their coverage.

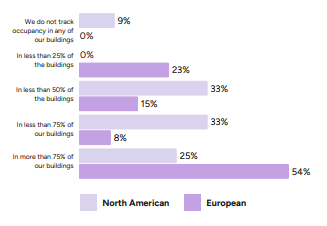

North American firms track occupancy less than European firms

Just 25% of North American respondents said their firm tracks more than 75% of the buildings in their portfolio. More than half (54%) of European respondents claimed to track more than 75% of buildings. This is especially surprising given that North American firms ranked occupant experience as their top real estate and facility management priority—it’s hard to optimize your space for occupants if you don’t know how they’re using it.

This difference in occupancy tracking also correlates with a difference in RTO adoption. According to JLL, US companies were far slower and less successful at getting employees back in the office. So it’s possible that European firms have simply had more incentive to implement occupancy tracking because more of their employees are actually using their real estate.

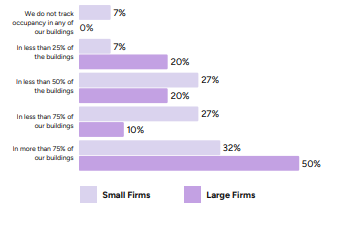

Larger enterprises tend to track more of their portfolios

Unsurprisingly, the firms with the most revenue (greater than $10 billion US dollars) were more likely to track more of their buildings. Presumably, these firms have more funds to allocate toward cost savings opportunities, and larger portfolios with greater potential for optimization. If a company’s footprint is large enough, occupancy tracking can often reveal entire floors or even buildings that can be offloaded by consolidating underutilized space. And when you have tens of thousands of employees, it’s more challenging to ensure they all have access to the resources they need to be productive and satisfied in the workplace.

Occupancy Tracking Technology

This survey broke down adoption of various occupancy monitoring technologies. Respondents were allowed to select more than one option in their responses.

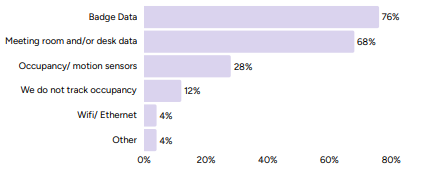

Most enterprises use at least two data sources to track occupancy

While badge data was clearly the most popular occupancy tracking solution (76%), just 20% of respondents indicated that they only used badge data. The majority of enterprises (68%) actually track occupancy through two or more data sources. The most popular combination of technologies was badge data and reservation data (56%), and 12% of firms even used three or more data sources.

This tracks with how Tango sees organizations using layers of occupancy data for space management. Badge scans provide somewhat reliable visibility into how many occupants are in a given building, and reservation data shows which reservable spaces they occupy throughout the work day.

For many companies, these two sources provide enough insight to analyze space utilization and find optimization opportunities. Sensor data can then fill in the gaps by showing how permanently assigned or non-reservable spaces are used, as well as giving better visibility into how employees actually use the spaces they reserve. (For example, if someone reserves a desk for the day, how much time do they actually spend there?)

No firms exclusively used sensors to track occupancy

While 29% of respondents were tracking occupancy with sensors, all of them were doing so in conjunction with another solution like office reservation software, badge scan data, or both.

Space utilization sensors are a more advanced occupancy tracking solution, and given the expense to implement and maintain them, they’re more likely to be used by organizations that are already pretty mature in their understanding and application of occupancy analytics.

If a company isn’t tracking occupancy but recognizes the value it could provide, it makes sense that they would start with a low-cost solution that gets them a usable amount of data (like badge scanning or reservation data), and then consider a larger investment based on how well it’s working and what they still need.

Additionally, badge scanning and reservation systems obviously serve other purposes beyond occupancy tracking. Badge scanning systems help keep buildings secure and limit unauthorized access. And reservation systems help coordinate the use of shared resources. Occupancy sensors are primarily an investment in optimization.

Just 4% of firms leveraged a network-tracking solution

Only 4% of respondents have adopted sensorless network-tracking solutions like Tango Occupancy. These solutions provide most of the occupancy data you’d get from IoT sensors at a fraction of the cost. Using your existing network infrastructure, they track WiFi and ethernet connections to your network to estimate the location of building occupants. Ethernet connections obviously have specific fixed locations, and WiFi signal strength can be used to roughly triangulate a device’s position.

While simple and effective—they don’t require specialized hardware or ongoing maintenance—sensorless occupancy monitoring systems are lesser known solutions that haven’t received as much attention as space utilization sensors. Just one enterprise represented in the survey was using a WiFi/Ethernet-monitoring system, and that was alongside sensors, badge scans, reservation data, and BMS software. If the other respondents were all aware of this low-cost solution, would 37.5% of them have still cited cost as the reason for not having full visibility into their portfolio?

For the majority of firms that are still just using badge data and/or reservation data, sensorless occupancy tracking systems represent a serious opportunity to improve visibility with a much smaller investment than installing sensors.

Occupancy Tracking Use Case Alignment

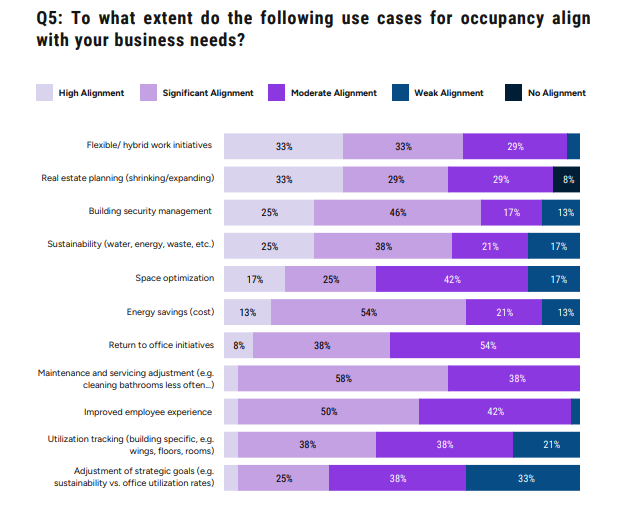

Survey respondents evaluated the degree to which specific use cases for occupancy tracking aligned with their business needs, with “high alignment” being the strongest and “no alignment” being the weakest.

Meeting hybrid work initiatives and real estate planning were most aligned with business needs

One in three respondents (33%) indicated that hybrid work initiatives and real estate planning were occupancy tracking use cases with “high alignment” with their business needs.

The survey distinguishes between real estate planning and utilization tracking. While utilization tracking may play a role in real estate planning, respondents were far less likely to say this had high alignment with their needs.

100% of enterprises saw at least moderate alignment with RTO and maintenance adjustments

Every firm and industry has slightly different needs and priorities when it comes to occupancy tracking. But there were only two use cases where no respondents indicated that there was weak alignment or no alignment: “return to office initiatives” and “maintenance and servicing adjustments.”

All of these enterprises are currently using some form of hybrid workplace model. So they’re probably not all looking to get everyone back in the office five days a week. But there are good reasons why employers committed to hybrid work may want occupancy tracking specifically for RTO initiatives:

- If and when they increase in-office requirements, they can measure the outcome.

- With more people in the office more often, coordinating the use of the same pool of shared workplace resources can present new challenges, and tracking and responding to demand is key to ensuring everyone can be productive.

As for “maintenance and servicing adjustments,” this is clearly an area where every enterprise sees value, and it makes sense: when you know how often equipment is being used and for how long, you can create more accurate preventive maintenance schedules and efficient, usage-informed service plans

Larger firms were less concerned with space optimization

When the results were filtered by a firm’s annual revenue, large firms clearly placed less importance on space optimization’s alignment with their business needs, with 90% giving it “moderate alignment” or less.

While this is surprising, given that larger firms presumably have significantly more space to optimize, and this optimization is one of the greater cost-saving opportunities offered by occupancy tracking, this is also a use case that typically requires a greater level of investment in occupancy tracking. You can optimize to some degree with quality reservation data, but you’d need sensors or a network-based system to optimize permanently assigned or non-reservable spaces. And as noted earlier, just 29% of respondents had sensors, and only 4% had a network-based solution.

Barriers to Occupancy Tracking Adoption

Respondents indicated the significance of six potential barriers to occupancy tracking adoption. Each respondent could only select one factor as the “most significant.”

Cost is the most significant barrier

Nearly half (48%) of firms claimed that the initial technology investment posed the greatest barrier to adopting occupancy tracking. For larger firms, this rose to 70%. And 44% of respondents said that maintenance and upgrade costs was at least a “very significant” barrier.

Occupancy tracking encompasses several distinct product categories that vary widely in cost. But 88% of these firms are already at least using badge scan data or reservation data, so they likely interpreted the question as “more advanced occupancy tracking” or “more comprehensive occupancy tracking” than what they currently had, especially since they’d already been asked to explain why they didn’t have more coverage.

Deploying the most basic occupancy tracking technology (badge scanning) can be pretty low cost, but it presents accuracy issues and limited scope. (Can multiple employees enter from a single badge swipe? Does it track exits? What can it tell you beyond who is in a building?).

Some desk booking software solutions, like, Tango Reserve are highly configurable and do everything you need right out-of-the-box, which makes them pretty affordable to implement. But some vendors offer “customizable” solutions that have to be built from scratch for your use case, and may require expensive upgrades at regular intervals. Experience with these solutions could lead firms to consider the entire category as too expensive or difficult to scale across their portfolio.

Sensor systems vary in complexity, cost, and necessary sensor quantity. And beyond the hardware itself, enterprises have to pay for the initial installation, potentially an ongoing subscription service, and regular maintenance to keep the system working properly. At any scale, this is likely to feel like an exorbitant cost, particularly for organizations that already have some occupancy data.

For firms that want cost-effective occupancy data a network-based occupancy monitoring system may offer the best of both worlds, with far lower costs than sensors, broader visibility than reservation systems, and more granular data than badge scanners.

Privacy concerns are universal

No respondent indicated that privacy concerns were the most significant barrier to adopting occupancy tracking. But no one said it was insignificant, either. With the exception of maintenance and upgrade costs, every other barrier was dismissed as insignificant by at least 12% of firms. Across industries and continents, companies are at least a little worried that their occupancy tracking data could infringe on their occupants’ privacy. Employees have shared these concerns for years.

Back in 2016, The Daily Telegraph had to abandon their rollout of desk tracking sensors on the first day of the rollout after employees criticized the perceived violation of their privacy. A year later, the British multinational bank, Barclays, received pushback from employees when implementing the same desk tracking sensors. And even in 2024, Boeing had to pivot on plans to use blurred vision cameras due to employee outrage, with an employee who leaked the plans even calling it “evil.”

While many occupancy tracking solutions only collect anonymized data, any form of tracking can be enough to derail adoption. Anonymous or not, the presence of sensors often makes people uncomfortable.

Concern about privacy certainly wasn’t the biggest barrier for any firms, but it was on everyone’s mind. And this is another reason a sensorless, network-based solution may be the ideal path forward for advanced occupancy analytics. Solutions like Tango Occupancy track occupants anonymously, and there’s no hardware to create the illusion of being personally watched.

Occupancy Tracking Maturity

Occupancy tracking technology has been in the workplace for more than a decade. Access badges have been in use for more than half a century. And companies were using meeting room reservation systems long before the normalization of hybrid work. Still, as the study’s earlier questions revealed, most enterprises have yet to invest in the most advanced occupancy tracking technologies. Respondents estimated their firm’s maturity in regard to occupancy tracking, with options ranging from “very mature” to “not particularly mature.” Each option included a specific definition:- Very mature: up to date on the latest technologies, using occupancy tracking for use cases such as sustainability

- Fairly mature: we conduct regular reviews of occupancy tracking technologies but do not proactively invest in it beyond space optimization

- Intermediate: we have technology in place and can benchmark our occupancy levels

- Not particularly mature: we know a little about available technologies but don’t go out of our way to research it, or have none in place

- Other: we do not see a relevant use case for occupancy tracking technologies

No firm reported that they were “very mature” in regard to occupancy tracking

Despite nearly a third of respondents (29%) indicating that they use sensors to track occupancy in addition to another occupancy tracking technology, none of our respondents estimated that their firm was very mature in their understanding of and investment in occupancy tracking.

This question was certainly subjective, but the descriptions of each option included specific criteria for maturity, and no one felt that their firm met this criteria for “very mature.” They’re not using the technology in ways one would expect from companies with more maturity in this area, despite many of them having some of the more advanced occupancy tracking technologies available.

Most enterprises have a narrow view of occupancy tracking

Occupancy data can serve a range of purposes for employers, but most firms still see it as primarily a solution for space optimization. Nearly two-thirds (64%) of respondents described their organizations as “fairly mature,” meaning that they don’t invest in occupancy tracking beyond space optimization. The remaining respondents estimated that their firm’s maturity in regard to occupancy tracking was lower.

In the study’s first question about real estate priorities, space optimization would have fallen under the priority of “optimizing building operations,” which received a much lower average priority ranking than “cost savings,” “occupant experience,” and “decarbonization.” Nearly half of the respondents (48%) gave it the second lowest ranking. Question five asked respondents to choose an occupancy tracking use case that had the most alignment with their business needs, and just 17% chose space optimization, giving it the fifth largest percentile out of the possible use cases.

Enterprises are not using occupancy tracking for the use cases they find most beneficial, and not because they lack the technology. In fact, the only firm using four distinct occupancy tracking solutions considered themselves “not particularly mature.” And more than half of the firms that considered themselves “fairly mature” (63%) had two occupancy tracking solutions in place.

This tracks with one of the main challenges Tango’s workplace experts see companies running into: they aren’t sure how to operationalize their occupancy data and leverage it for these other benefits. The answer is not found in more data. It’s found in getting more insights from the data that’s already being collected. Which is why the next question explores how enterprises are integrating their occupancy data.

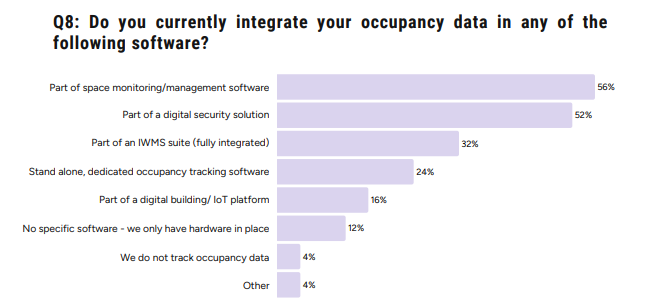

Occupancy Data Integration

Where an organization stores and accesses their occupancy data completely shapes their ability to utilize it. If the data only “lives” in a standalone solution, or worse, the hardware itself, who will access it, and what for? Respondents shared how they’ve integrated their occupancy data with other software, specifying where they have access to this data.

Most firms integrated occupancy data with space management or security

Space management and security are the low-hanging fruit for occupancy tracking integrations. Enterprises need these solutions for other purposes, and many of these technologies can’t perform their intended function well without occupancy data.

As a form of access control, badge scanning technology easily lends itself to digital security solutions. But many of the respondents who integrate occupancy data with a security system weren’t using badge data, and not all those who collected badge data integrated it with a security system. Security was also a common integration for respondents who track meeting room or desk booking data.

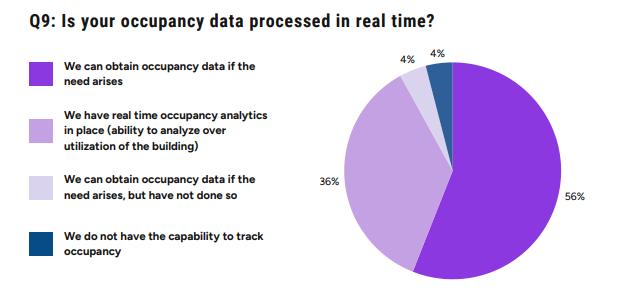

Real-Time Occupancy Tracking

At Tango, we’ve made the case for years that real-time occupancy tracking is crucial to effective workplace management. If employers want to successfully balance the supply and demand of workplace resources, they need visibility into what’s happening moment-to-moment, so they can foresee problems and mitigate them quickly. The longer the intervals between data collection and processing, the harder it is to accurately understand your utilization. The survey asked respondents about their ability to process occupancy data in real-time, with possible responses including:- We have real-time occupancy analytics in place

- We have a periodic report looking at historical occupancy data

- We analyze occupancy on a project-basis

- We can obtain occupancy data if the need arises

- We can obtain occupancy data if the need arises, but have not done so

- We do not have the capability to track occupancy

100% of firms with real-time tracking capabilities had at least two occupancy tracking technologies

One might assume that real-time occupancy analytics is only possible when firms have vast networks of space utilization sensors in place. But the reality is that only one third of respondents with real-time occupancy tracking capabilities were using sensors. All of them had badge data and reservation data, and could process this data in real-time.

Conclusion: Enterprises need better ways to use the occupancy data they have

Enterprises know what they want from occupancy tracking, but don’t know how to get it. Even firms with significant investment in advanced occupancy tracking technologies don’t believe they’re very mature when it comes to occupancy tracking, and have yet to utilize this data source beyond space optimization. For today’s hybrid workplaces, enterprises don’t need more data—they need better ways to use what they already have, regardless of their level of investment.

As a leading provider of integrated workplace management systems (IWMS) software, Tango gives organizations a range of data agnostic, highly integrable tools that leverage your occupancy data to actually impact real estate decisions and business initiatives.

Whatever occupancy tracking technology you have, Tango Space makes all your data visible in one system, using it to build live floor plans, streamline scenario planning, and facilitate advanced occupancy analytics. For hybrid workplaces, Tango Reserve makes every shared resource reservable and empowers employees to coordinate time in the office with their colleagues. For broader visibility into workplace occupancy, Tango Occupancy uses your existing network infrastructure to show real-time occupancy and patterns over time.

Each of these solutions help you translate your occupancy data into tangible outcomes, from hybrid work and RTO policy changes to lease decisions, sustainability initiatives, maintenance savings, and more.

Want to see how Tango helps you get more from your occupancy data?