From real estate planning to space optimization, occupancy tracking has become a valuable component of how enterprises maximize the value of their workplaces. But while most organizations collect some form of office occupancy data, many are relying on tools that weren’t built for occupancy tracking.

To better understand how enterprises are approaching occupancy tracking today, Tango surveyed real estate, HR, and facilities leaders at major North American and European firms. The findings, published in The 2025 Enterprise Occupancy Tracking Report, offer a detailed look at the technologies organizations are using, how much of their workplace is being tracked, and where the most advanced teams are finding value.

In this article, we’ll explore how leading enterprises approach workplace occupancy monitoring by looking at:

- The tools they’re using

- How much of their portfolios enterprises track

- The use cases enterprises care about most

The occupancy tracking tools enterprises are using

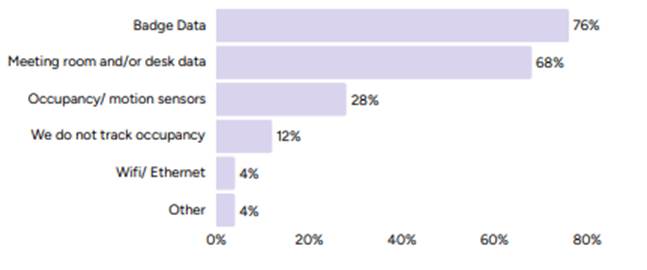

Enterprises today rely on a range of technologies to track occupancy, but few are using tools specifically built for that purpose. The research we conducted found badge data to be the most widely used method, adopted by 76% of firms, followed closely by meeting room or desk booking software at 68%.

Most organizations aren’t relying on a single data source. According to the research, 68% of firms use two or more occupancy tracking technologies, and 56% combine badge data with reservation data. This pairing offers both building-level entry visibility and workspace-level intent data. Only 20% of firms rely on badge data alone, and none reported using sensors as their sole data collection method.

Here’s how the most common technologies compare, and how leading firms are using them more strategically.

Badge data

Badge systems offer a basic view of who enters and exits a building and when. Because these systems are typically already in place for access control, the data is easy to access and inexpensive to repurpose. But the visibility is limited. Badge data typically doesn’t track how people move through a building or which spaces they use, and it can be unreliable when employees bypass scanners or enter or exit in groups.

Reservation data

Desk and meeting room booking systems track how employees reserve and use shared spaces. This data offers better granularity than badge scans and is especially useful for understanding demand, scheduling patterns, and space preferences. However, reservation data assumes people actually use the spaces they book, which isn’t always the case. It also doesn’t capture activity in permanently assigned or informal spaces.

Occupancy sensors

Sensors provide real-time, high-precision data about how a space is actually used, regardless of whether it’s reservable, assigned, or informal. They’re well suited for tracking unbooked zones like lounges, shared equipment areas, or circulation paths. Because they don’t rely on employee behavior (like scanning or checking in), the data tends to be more accurate. However, sensors come with high installation and maintenance costs, which limits adoption (only 29% of firms use them).

Network-based tracking

Sensorless systems like Tango Occupancy use existing Wi-Fi and Ethernet infrastructure to estimate occupant location. These tools provide continuous, anonymized visibility into space usage without the need for physical sensors, making them both cost-effective and privacy-sensitive. Adoption remains low (4%), likely due to limited awareness, but this approach offers a powerful alternative for firms looking to expand visibility without high hardware investment.

Combined tools

The most effective organizations don’t rely on a single method. Instead, they layer tools to support a wider range of use cases. Badge data offers high-level entry trends, reservation systems reveal planned usage, and sensors or network-based solutions fill in the behavioral gaps. By combining these technologies intentionally—rather than incidentally—leading firms build a more complete, flexible, and actionable view of occupancy across their workplace.

How much of their portfolios enterprises track

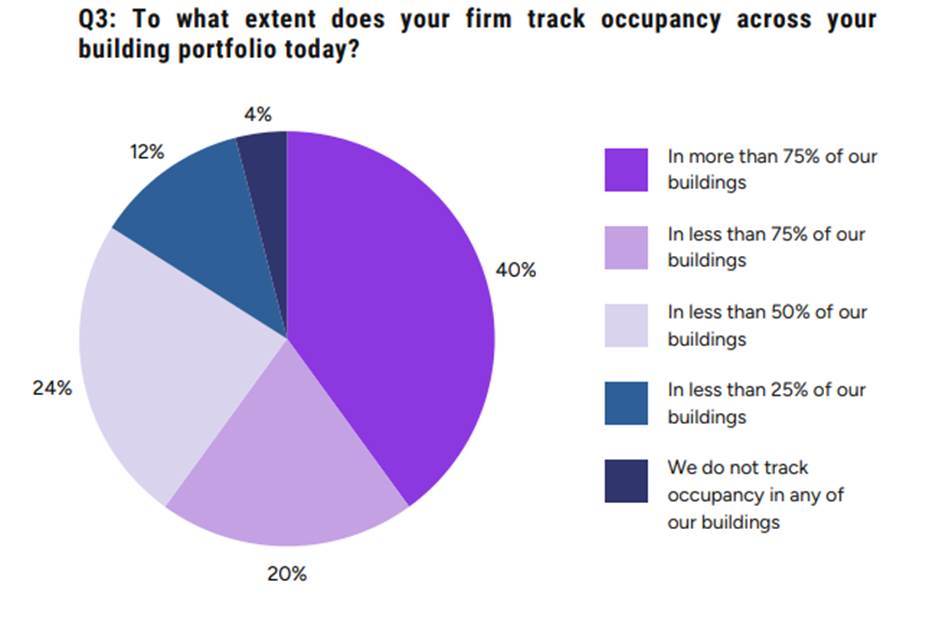

Even when enterprises have the tools to track occupancy, that doesn’t mean they’re using them across their entire portfolio. In fact, most aren’t. According to our research, 60% of firms track occupancy in less than 75% of their buildings, and 40% track occupancy for less than half of them. Just 40% of respondents reported tracking more than 75% of their portfolio, and no firm claimed full coverage.

For companies operating across hundreds or even thousands of locations, this represents a significant gap in visibility. Without occupancy data, real estate decisions about those buildings are based on assumptions or anecdotes, not actual usage patterns.

Why firms aren’t tracking more

Cost is a common barrier preventing greater adoption of occupancy tracking across organizations’ portfolios. More than a third of respondents (37.5%) said cost was one of the reasons they haven’t expanded coverage. While basic systems like badge scanners are relatively affordable, scaling those systems or adopting more advanced solutions adds up quickly. Even when technology is already in place, enterprises weren’t keen to extend it to lower-priority sites.

Some firms also deprioritize tracking in field offices, specialized facilities, or locations with infrequent use. Not every building needs occupancy data to optimize its use.

A few respondents expressed concern that tracking more buildings would simply generate more data than they could use. Without the right tools to centralize, interpret, and act on that data, the fear is that expanded coverage might create more reporting friction than operational insight.

How leading firms approach coverage

Leading organizations don’t aim for 100% coverage by default. Instead, they track occupancy where it’s most likely to support meaningful decisions, such as high-cost buildings, heavily used spaces, or locations being considered for consolidation or renewal. From there, they expand coverage based on goals, available resources, and their ability to operationalize what they collect. The emphasis isn’t on collecting more data, but on collecting the right data in the right places.

The occupancy tracking use cases enterprises care about

Most enterprises are collecting occupancy data. But collecting it and using it are two different things. Let’s take a look at what organizations want from occupancy data, where it aligns with their stated priorities, and what becomes possible when they begin to act on it in real time.

The use cases firms value most

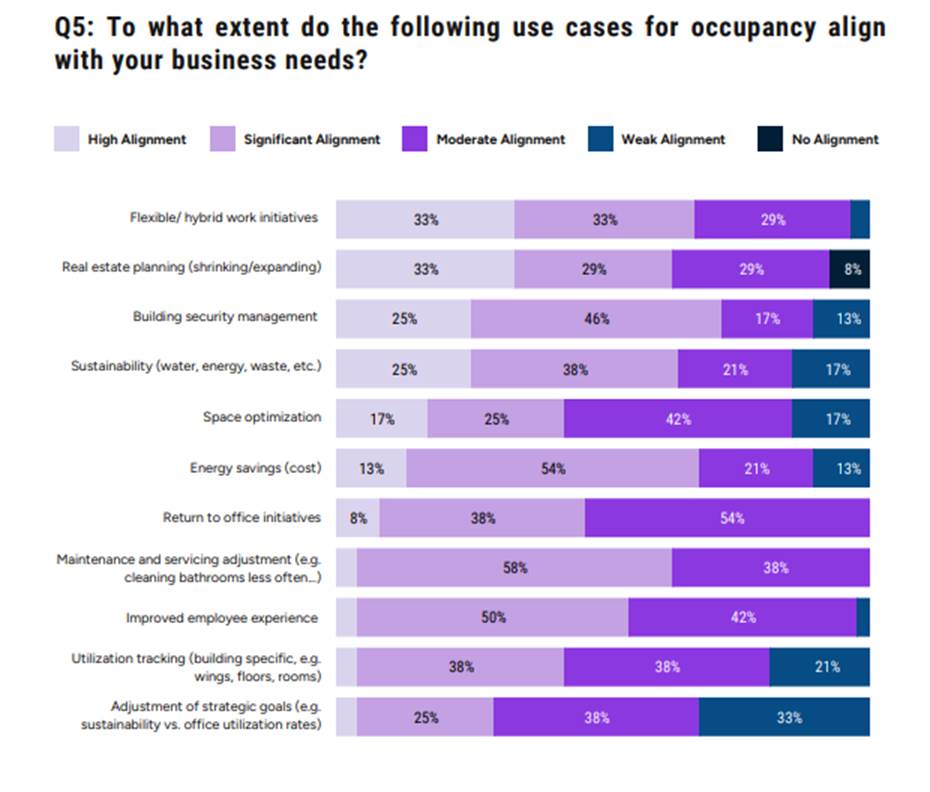

While space optimization remains the most common way organizations use occupancy data today, that doesn’t mean it’s the use case that matters most to them. Just 17% of firms said space optimization was highly aligned with their business needs. Meanwhile, other use cases with stronger alignment are being used less frequently.

Hybrid work initiatives and real estate planning both stood out as top priorities, with a third (33%) of respondents rating each as highly aligned. Maintenance and servicing adjustments showed broad appeal, with all respondents indicating at least moderate alignment, although only 4% indicated high alignment.

These results suggest that while organizations see strong potential in a range of use cases, many may not yet be putting their data to work in those areas. In many cases, firms could be using occupancy data to better support hybrid work policies, leasing decisions, and employee experience, but haven’t fully connected those capabilities to their operational workflows.

The most mature firms see occupancy data not just as a way to analyze past space usage, but as a tool for evaluating policy outcomes, identifying emerging needs, and experimenting with new ways of using space.

The value of real-time visibility

A little over a third (36%) of firms reported having real-time occupancy analytics in place. Those that do are able to make workplace decisions that are more responsive, adaptive, and grounded in live conditions rather than historical patterns.

With real-time data, organizations can get alerts about overcrowding, redirect employees to available spaces, and fine-tune hybrid coordination as it’s happening. This is especially valuable during high-demand moments like all-hands meetings, return-to-office surges, or large in-office events, when typical usage patterns may not apply.

And real-time capabilities don’t necessarily depend on advanced hardware. In fact, most firms with this capability weren’t using sensors at all. Three out of four were relying on badge data and reservation data alone—processed through platforms that centralize and surface that information in real time. When paired with tools like Tango Reserve, these systems can even give employees personalized reservation recommendations based on past preferences, current availability, and team members’ schedules.

Rather than focusing on surveillance or precision, real-time analytics in mature organizations is about flexibility. It allows teams to respond to needs as they emerge, whether that means reallocating space, adjusting policies, or simply helping employees find the right place to work.

How mature firms use their data more intelligently

Occupancy tracking has become a critical function for organizations navigating hybrid work, fluctuating space demands, and growing pressure to optimize costs. But while most enterprises have access to some form of occupancy data, few are using it to its full potential.

For firms looking to mature their approach, the opportunity lies in integrating occupancy insights into everyday operations. Data becomes far more impactful when it isn’t just collected or reported, but is used to guide decisions across leasing, space planning, facilities management, sustainability, and employee experience.

Organizations can use occupancy data to inform lease renewals, consolidations, and expansion plans. It can help them prioritize capital projects where utilization is highest, optimize cleaning and maintenance schedules based on actual usage, and adapt hybrid work policies to better match demand.

Occupancy tracking maturity isn’t about collecting more data—it’s about knowing where to focus, what to measure, and how to act. The most strategic organizations don’t just track occupancy. They use it to shape what happens next.

Learn more about the state of workplace occupancy tracking

In The 2025 Enterprise Occupancy Tracking Report: Stats, Challenges, Insights, surveyed North American and European enterprises from five different industries about their experience with occupancy tracking. Respondents shared insights into their top priorities, their greatest barriers to adoption, and how well different use cases align with their business needs.

You can access the entire report for free—we won’t even ask for your email.