Retail site selection is the process businesses use to identify, compare, and choose the best locations for their stores and restaurants. For decades, retailers have used a combination of expertise and site selection software to create site models and sales projections that accurately reflect the opportunity a site presents.

With a better site selection process, you can consistently choose the locations that set your stores up for success, bolster your brand, and give you a competitive advantage. And since you have finite resources and seemingly endless opportunities, retail site selection isn’t just a matter of ruling out the duds and saying “yes” to the prime locations. Site selection should lead you to better prioritization, which depends on your ability to compare sites that may have little in common.

Unfortunately, most businesses still ultimately make decisions based on a series of assumptions. Their models can’t quantify enough variables and incorporate their likely impact. Without comprehensive site models, artificial intelligence and machine learning can’t reliably predict performance, and you’re stuck making massive real estate investments based on your “best guess.”

Tango is changing that. Our site selection software, Tango Transactions, equips you to remove assumptions, so you can identify, compare, choose, and prioritize the best opportunities for your business to expand to new trade areas, relocate or consolidate stores, and renew existing leases. By building more accurate models, we help you significantly reduce the margin of error and avoid costly real estate mistakes.

This guide will walk you through the keys to retail site selection and identify common pitfalls. Along the way, you’ll see how we enable our customers to build better models and choose better sites.

To begin, let’s talk about what makes a site work for your business.

Analyze what your best locations have in common

While there’s a wealth of site selection criteria and principles that can help you identify what an effective site generally looks like, the ideal location is always going to depend on your business. What makes your best locations work so well? It could be their proximity to businesses and attractions that complement your stores, such as an airport, a public park, a school, or a stadium. Maybe they all have co-tenants that generate a certain amount of foot traffic. Perhaps they’re all right next to a freeway offramp.

Whatever your best sites have in common right now, you should incorporate that into your site selection criteria. These are your secret ingredients. Even if they aren’t the most influential factors in your location strategy, it’s worth evaluating how closely a potential site aligns with the top locations you have now.

Retail site selection and sales forecasting is a blend of art and science. Getting it right requires you to apply your business’ unique experience to the tried and true methodologies of site modeling.

Consider your current infrastructure

It’s nice to imagine that any site is on the table. But if you’ve spent decades building your infrastructure in Portland, it’s a lot harder to suddenly launch a new location in, say, New York City. Sure, you might find seemingly suitable sites there, in trade areas that perfectly match your target demographics. But that site could essentially force you to create a new supply chain from scratch, instead of leveraging the one you already have.

That doesn’t have to mean you’ll never achieve your dream of expanding across the country. But before you jump from coast to coast, maybe you should establish a chain of locations that span across the country or strengthen your regional foothold. As you prioritize which sites to move forward with, think about how they fit into your larger vision and your current operations.

When you have your sights set on a location that’s far beyond what your current infrastructure can handle, you might be tempted to see that infrastructure as a liability. But it’s an asset. And if another site is better equipped to utilize that asset, that should be a significant factor in your selection. Nearby locations help you manage inventory, borrow from your established employee pool, leverage advertising spend, and provide other operational support.

Given the sheer volume of sites you could analyze and compare, it can help to let your infrastructure guide the process early on.

See how we helped an established regional tool company expand to new states in our case study on Northern Tool.

Apply your customer data to local demographics

A bustling trade area isn’t necessarily a good opportunity. If the local population doesn’t align with your customer base, an otherwise great site will still struggle to be successful. Your customer data is one of the main inputs you need to build a realistic sales forecast.

Using site selection software with geographic information system (GIS) capabilities lets you apply that customer data to local demographics. By combining your internal data with external sources like mobile location data, you can uncover where your best customers live, shop, and spend their time. If you have a thriving ecommerce business with a national presence, you may even be able to identify pockets of current customers. (More on that later.)

This can get far more granular, too. Let’s say you’re comparing a site inside a shopping mall with one on a college campus. Using geofencing, you can create a border around the campus and the mall and monitor the daily flow of people in and out of the geofenced area, comparing them to your target demographics. This lets you get a more accurate picture of who each site will naturally reach.

Customer and demographic data are the starting point for gauging the total opportunity a trade area presents. If your site could reach every person in the trade area, what kind of figures would you be looking at? As you dig into the specifics of the site—it’s visibility, accessibility, nearby competitors, etc.—you’ll see how big your piece of the pie could be.

While you’re obviously looking for the largest concentrations of your best customers, you want to evaluate the potential of the entire local population. Suppose married women between 30–40 spend an average of $200 annually in your women’s shoe store. But the largest percentage of your sales come from single college-educated women between 20–29, who spend $50 annually on average. And smaller percentages of sales come from teens, men, women between 41–50, etc.

You’re not just looking for sites in trade areas with a high volume of your best demographic. You’re looking for the sites with the greatest potential to tap into the biggest total opportunity.

Want to learn more about how to estimate retail opportunities with predictive analytics? Get a free copy of our ebook, Retail Renaissance: How Predictive Analytics Is Transforming Site Selection.

Study traffic patterns

If people have to go out of their way to visit your business, you’ll simply have less business. It creates friction every time someone considers visiting your store. When they’re thinking about what to eat or planning a stop on their commute to or from work, their desire to choose your business will often be outweighed by more convenient alternatives. Instead of going across town to visit your paint department, they’ll swing by the Sherwin-Williams store they drive past every day.

Traffic patterns help you see where your site will be most convenient for the most people. Using mobile location data, you can even isolate traffic patterns to your target demographics. Traffic patterns alone can’t fully account for how visible or accessible a site is, but they give you a much better picture of who your site has the potential to reach.

When you move into the trade area, your store will likely have some impact on the traffic flow that’s already present. But cut yourself off from the routes and habitual navigation patterns the local community is already accustomed to, and you’re fighting an uphill battle to tap into demand. A strong brand and lack of competitors can certainly help you reshape those patterns, but the more you can leverage the existing flow, the easier it is for success to come. You’re going to the demand, instead of working against the grain to make it come to you.

Evaluate nearby competitors

You never want to rule out a site just because it’s near competitors. But that’s certainly going to affect your sales forecasts. This is another aspect of retail site selection that often rests on assumptions. But you don’t have to blindly guess the impact of your competitors’ nearby stores!

Whatever your serviceable area is, you’re looking at the percentage of that area that overlaps with a competitor’s serviceable area. With mobile location data, you can analyze how a competitor’s serviceable area aligns with the local demographics, and you can even use geofencing to estimate how much business a specific location actually sees throughout the week.

As you compare sites, take the time to estimate the impact of your competition. Simply scoring sites based on the number of competitors or their proximity could cause you to overlook good opportunities and overestimate bad ones. If competitors have already maxed out the demand in your site’s serviceable area, that site’s probably not your best option.

Account for cannibalization

Cannibalization works similarly to estimating the impact of competitors, but instead, you’re looking at the effect your new location would have on your own nearby stores or your sister stores. Your parent company wouldn’t want your site’s success to come at the cost of hurting one of their other store’s profitability. Especially if you could’ve chosen another site that would’ve brought them more new revenue.

Estimating the overlap between your stores’ serviceable area and the impact they’d have on the other’s sales helps you see how much your new site would shuffle revenue around and how much it could actually increase your market penetration. Some trade areas have room for numerous locations. Others would be over-saturated with two.

Incorporate criteria from in-person site surveys

Maps are incredibly useful. But you can’t tell everything about a site just by overlaying demographic and mobile data on a map. In-person surveys are where experience and intuition play a vital role in site selection. Software shows you how a site fits into the trade area’s traffic flow. Surveys help you evaluate how well the specific site can actually utilize that traffic flow, based on your criteria surrounding visibility and accessibility.

From a map, you might not be able to tell that nearby buildings block the view of your store until you’re driving past it. Or that the parking lot couldn’t handle the demand for your drive thru service at peak hours.

You may not always be able to quantify information you collect in-person, but incorporating these insights helps you more accurately compare the new site to existing locations, which ultimately gives you more useful models and realistic forecasts.

Recognize the omnichannel impact

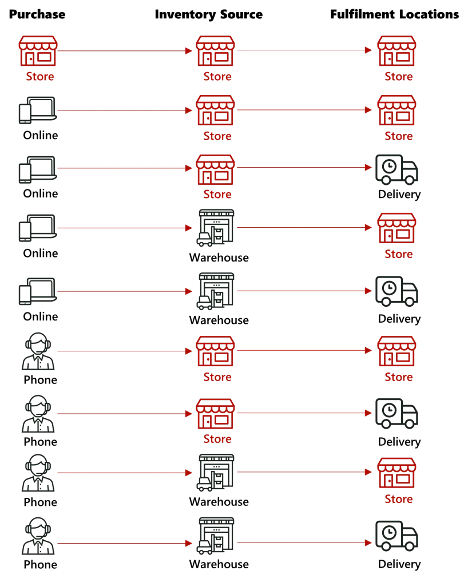

Your brick-and-mortar stores aren’t just a point of purchase. They’re order fulfillment centers and inventory sources, too. If you have a strong ecommerce presence, your physical stores can play a valuable role in supporting and growing that side of your business as well.

If pockets of your online customers live, work, and spend time in a trade area you’re considering, then your physical store could lead them to spend more with you and use your business more often, since they’ll gain the ability to shop in-person and use alternative fulfillment methods like buy online pick-up in-store (BOPIS), local delivery, and curbside service.

While brands often focus on their site’s impact on in-person transactions, it’s important to remember that brick-and-mortar stores play a role in 7/9 of the ways you get your products in your customers’ hands.

Depending on how strong your ecommerce business is, omnichannel retail could influence which part of a trade area is more valuable to you. For example, if your customers love your local delivery service, it may make more sense to place your stores closer to where your target demographics live, not just where they work or spend time.

Build better site models

The last thing you want is a foundation of assumptions holding up your store. Retail site selection is about removing as many assumptions as possible, using a combination of internal and external data to create reliable models. Even though not everything is quantifiable, the more criteria you can incorporate, the more accurately you can compare a site to other locations in your lease portfolio.

Most retail site selection software doesn’t utilize enough criteria to draw accurate comparisons. This is where retailers often get site selection wrong. Even the best algorithms make errors when they don’t have all the inputs. Tango Transactions lets you create stunningly accurate site models, pulling in all the factors that influence sales to help you make the best choice, every time.

Want to see the difference?