Embedded leases are an important component for accounting compliance. For some organizations, this is the greatest source of failure to comply with the new lease accounting standard leading to higher audit costs and increased scrutiny from governing bodies.

Even the best informed and savvy business managers struggle with this. They didn’t apply for an accounting job after all. That’s where Tango and our partners can help.

This article will cover the criteria companies need to use to identify embedded leases, some examples of what they look like, and how you can simplify this entire process.

Let’s begin by discussing what an embedded lease actually is.

What is an embedded lease?

An embedded lease is a legal agreement that may not generally be considered or referred to as a “lease,” but qualifies as one under ASC 842 and IFRS 16. Neither standard explicitly defines the term embedded lease, but it is a common industry term for these less obvious agreements. The standards do, however, define the elements of a contract that force you to treat it as a lease in financial statements.

According to ASC 842, “A contract is or contains a lease if the contract conveys the right to control the use of identified property, plant, or equipment (an identified asset) for a period of time in exchange for consideration. A period of time may be described in terms of the amount of use of an identified asset (for example, the number of production units that an item of equipment will be used to produce).”

There are some notable exceptions to this definition, including:

- The right to use intangible assets such as client lists, copyrights, and patents.

- Leases for the exploration of natural resources such as oil and gas.

- Biological assets including timber, leased inventory and assets under construction.

ASC 842 doesn’t apply to these types of assets and agreements.

As public and private companies have been required to adopt ASC 842 and IFRS 16 in recent years, identifying embedded leases has arisen as one of the biggest challenges in lease accounting. Organizations have to devote more time and apply extra scrutiny to contracts they never had to consider before.

How to identify embedded leases

Leases often don’t have a title clearly stating “LEASE” at the top of the first page. Some don’t even mention the word lease anywhere in the contract. Whether buried in clauses of a broader facilities lease or separate contracts with suppliers or manufacturers, embedded leases are a pesky part of your lease portfolio.

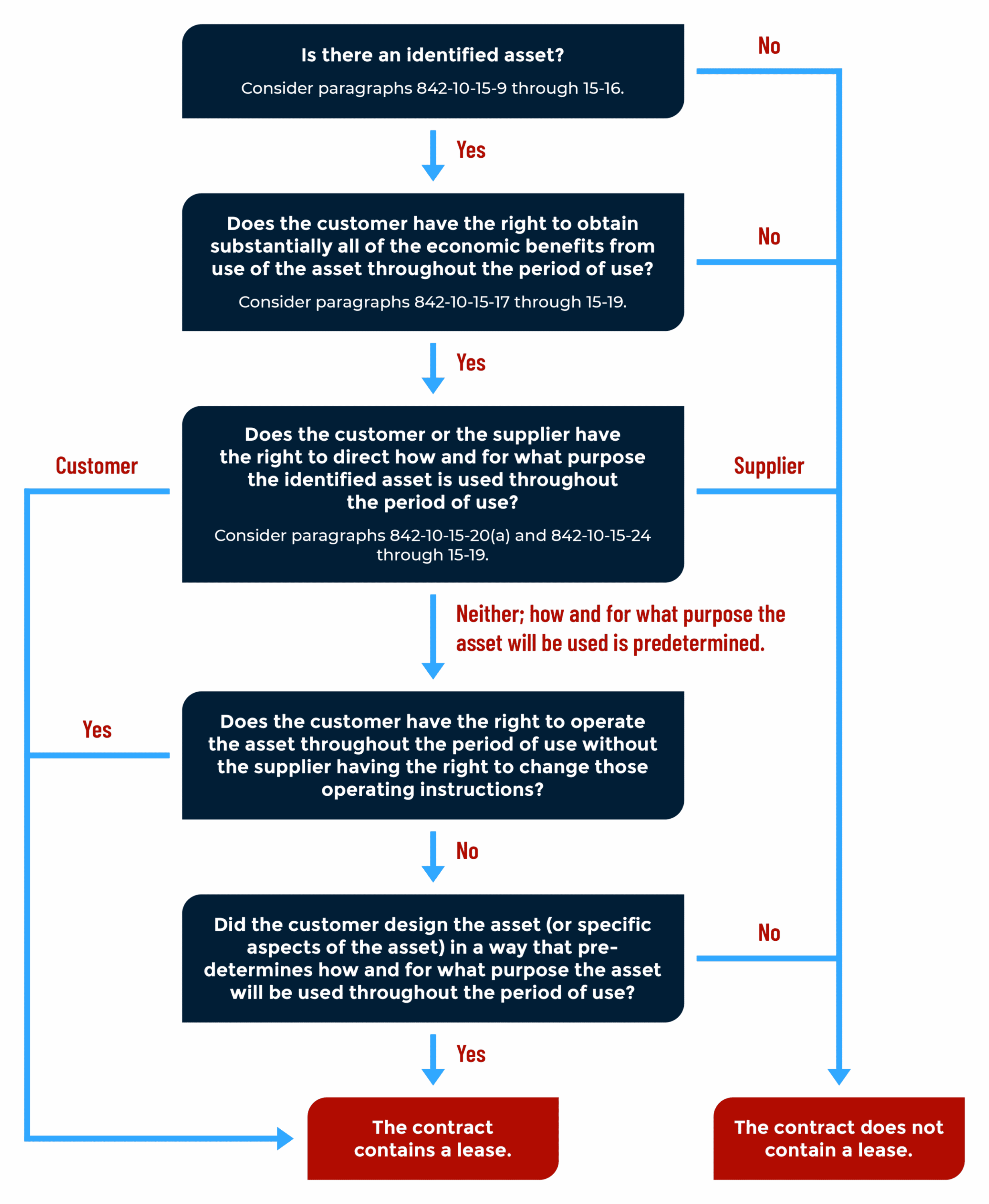

While embedded leases can take many different forms and appear in various legal documents, they all share particular characteristics that determine which party is benefiting from an asset and which party is bearing the financial responsibility for it. The flowchart below is from ASC 842 and is an excellent visual guide to determine if a contract contains a lease. The first three questions give specific citations to the codification, while the last two will require more judgment. A lot of thought and details go into the determination.

ASC 842’s definition of a lease gives us four criteria for identifying whether a contract is or contains a lease. If it doesn’t satisfy all four of these conditions, it’s not a lease.

1. It identifies a specific asset

“An asset typically is identified by being explicitly specified in a contract,” ASC 842 notes. “However, an asset also can be identified by being implicitly specified at the time that the asset is made available for use by the customer.”

If your agreement contains serial numbers as part of the main agreement, or lists them as an addendum, exhibit, or part of ongoing service, then it almost certainly is a lease for that property. Where the identification happens is not important. It’s a question of if, not where or how.

Sometimes the asset isn’t always clearly defined. Instead, it’s implied by the context of the agreement.

For example, your restaurant business might have a soda fountain machine you received “for free,” but if a contract identifies a specific type of soda machine, it may be a lease. The exact serial number may be less important than the lessor’s economic incentive to substitute the asset.

A wink and a nod to that soda fountain isn’t a get out of jail free card. We still have to review the language and real world use. Additionally, this is not an all or nothing test. A portion of an asset can be leased.

Sometimes you might be able to substitute the asset for another, which could negate the embedded lease. But terms and circumstances may remove that option or make it cost prohibitive. According to ASC 842, “If the asset is located at the customer’s premises or elsewhere, the costs associated with substitution are generally higher than when located at the supplier’s premises and, therefore, are more likely to exceed the benefits associated with substituting the asset.”

Similarly, “If the supplier has a right or an obligation to substitute the asset only on or after either a particular date or the occurrence of a specified event, the supplier does not have the practical ability to substitute alternative assets throughout the period of use.”

2. It gives you the exclusive right to control or benefit from an asset

In order for an agreement to qualify as a lease, the owner of an asset has to transfer control to a lessor. You “control” an asset when one of the following criteria is met:

- You have the exclusive right to direct the asset’s use; how and for what purpose

- You obtain “substantially all” of the economic benefits for the duration of the lease; directly or indirectly, any cash flow paid to the lessor notwithstanding

3. It lasts for a known period of time

Every lease has a fixed duration. At some point, it ends. You no longer have the exclusive right to control or benefit from the asset, and you no longer bear the financial liability for it.

This isn’t always explicitly defined in the clause where the asset, benefit, and compensation are named, either.

If an equipment lease is embedded within a real estate lease, for example, it can be inferred that, unless otherwise specified, the equipment lease is the same duration as the real estate lease. Time is not the only measure of the duration of a lease. Limitations on the use of the asset such as usage or production can also define the term of the lease.

4. It specifies an exchange of consideration

One of the challenges with identifying embedded leases is that they often involve less obvious forms of compensation for the right to use the asset.

Supply contracts are a great example. If you know what the phrase “there’s no free lunch” means, then you understand the issue. A supplier will “throw in” an asset’s use for free if you exceed some threshold they set for the purchase of something else. You are paying for that asset one way or another.

The supplier is not that generous. The amount of compensation for the asset should be assessed and applied to lease accounting treatment. Accounting for this part of the payment that must be treated differently is part of the complication around the practical application of the standard.

That soda fountain machine may appear to be “free,” but if you have to pay the vendor for the soda supply, cups, lids, and straws on an ongoing basis in order to continue using it, it may be an embedded lease.

Account for every lease, embedded or not

Many businesses are struggling with embedded leases right now. For years, you haven’t had to worry about these contracts and clauses in your financial reporting, which makes it easy for embedded leases to fall through the cracks. Complying with ASC 842 can feel overwhelming, but with the right infrastructure in place, it’s a breeze.

Tango’s partners can help you identify embedded leases and take that process off your plate. Our implementation teams have worked across over 100 lease clients, and our consultants regularly help organizations navigate embedded leases. Once you’ve identified them, Tango’s systems help you track and account for them with our lease administration and lease accounting tools.

Want to see how it works?