Leases allow organizations to pay for access to land, facilities, and equipment without bearing the full responsibility of owning them. Corporate leases legally bind an organization to pay for access to these resources, often for years at a time. Every lease your organization takes on represents an asset and a financial liability to your business.

Until recently, these long-term assets and liabilities weren’t always required to make their way onto balance sheets, making it difficult for investors, government agencies, and other entities to evaluate a company’s complete financial situation and true level of risk. With the advent of FASB’s latest lease accounting standard, ASC 842, public and private companies are now required to fully disclose both financing leases and operating leases.

That means lease accounting now involves a lot more work on the part of lease administrators and finance departments. These new standards come with new layers of compliance and greater complexity.

Lease accounting is the process of incorporating leases into financial reporting, and it involves:

- Identifying leases

- Classifying leases

- Analyzing and reporting on their financial impact

While every company is now working toward complete financial transparency, the technical details of lease accounting look a little different for each one—because the process varies depending on whether your company is US based or operates internationally, the type of lease you’re disclosing, and the complexity of your lease portfolio.

In this introduction to lease accounting, we’ll give an overview of what lease accounting entails, some of the challenges involved, key considerations for corporations, and how large organizations can simplify the entire process.

Identifying leases

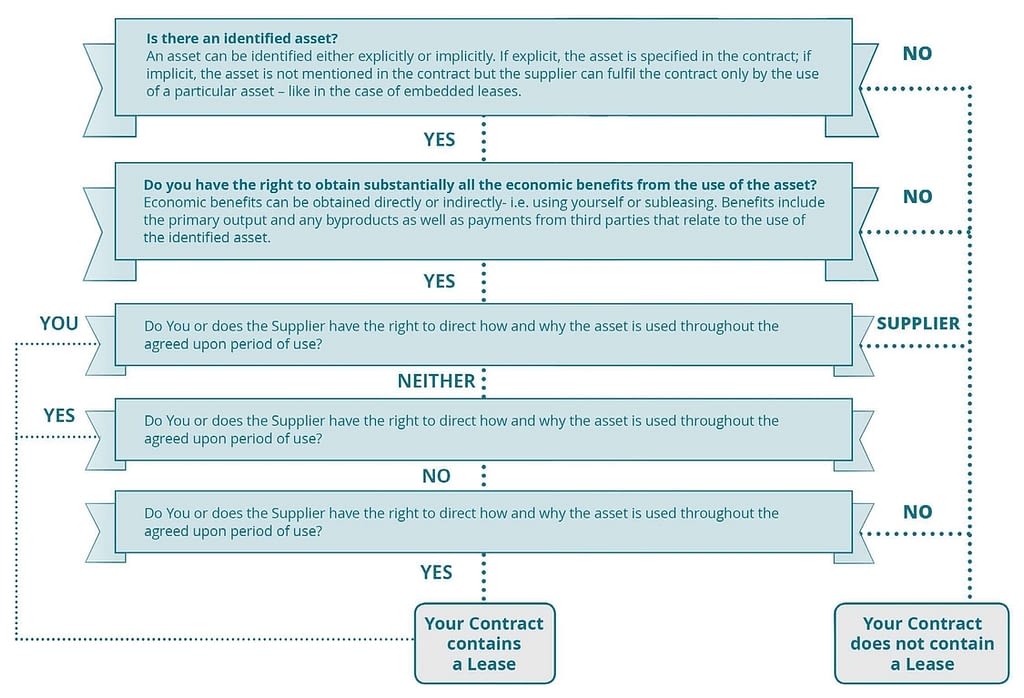

First and foremost, in order to disclose all your leases, you need to determine which contracts include leases and which assets qualify as leases. It isn’t as straightforward as it may sound. For example, suppose you have a soda machine which you didn’t pay for up front, but you’re contractually obligated to pay the owner a premium for the machine’s soda supply over a fixed period of time. This is what’s known as an embedded lease, wherein your right to use the property is directly tied to a fixed financial commitment to the owner of the property.

Or an equipment lease, such as the the use of machinery or other equipment on a rental basis. Ownership rests in the hands of the lessor, while the lessee uses the equipment for the time amount allotted in the lease. Per ASC 842, equipment leases with a term greater than 12 months must now be accounted for on an organization’s balance sheets.

The larger the scope of your operations and the more locations your business has, the more tedious it becomes to wade through contracts and identify each distinct lease. For each lease you identify, you’ll need to collect all relevant data to comply with regulations, such as key terms, dates, and clauses which impact your financial obligations.

Classifying leases

Lease classification determines how a lease will be disclosed, which types of documents it appears in, and the level of risk it represents. The two main lease classifications are operating leases and capital leases (or a finance lease), but there are subcategories as well. For lessees (the party paying for access to the asset), operating leases and capital leases are the only classifications to worry about.

| Lease Classification | Overview |

| Operating lease | Lessor retains ownership and bears most of the risk |

| Finance lease | Lessee either gains ownership or bears most of the risk |

| Sales-type lease | Finance lease where lessor reports profit or loss |

| Direct financing lease | Finance lease where a portion of payments go toward interest |

Operating lease

If a lease doesn’t transfer ownership of the asset at the end of the term, it’s an operating lease. In an operating lease, the lessor (the party selling the right to use the asset) bears the largest share of risk, as they retain ownership throughout the course of the lease.

In the past, operating leases were considered “off-balance sheet financing.” Since these leases are generally required for day-to-day business operations and the lessee is effectively renting the right to use the asset, they qualify as operating expenses rather than capital expenses, and they didn’t get recorded on the lessee’s balance sheets.

However, ASC 842 now requires that all leases with a duration greater than 12 months need to be recorded on the balance sheet. Since these represent long-term liabilities, corporations need to be more transparent about disclosing them.

At the end of an operating lease, the lessor retains ownership of the lease, and the lessee usually has the option to renew.

Finance lease (or capital lease)

Finance leases, formerly classified as “capital leases” under ASC 840, involve the transfer of risk and benefit to the lessee, often with an option to transfer ownership as well. Some finance leases explicitly define the transfer of ownership in terms or clauses, while others are classified as finance leases because the lessee effectively uses up the asset or winds up paying close to the equivalent of its fair market value over the course of the lease.

If a lease term represents 75% or more of the remaining economic life of an asset, it’s a finance lease. If the net present value (NPV) of the lease payments reaches 90% of the asset’s fair market value, it’s a finance lease.

For example, if the asset is expected to last for 10 more years, and the lease duration exceeds 7.5 years, the lease would be classified as a finance lease. If a building is worth $1,000,000, and over the course of the lease, the NPV of the payments amount to $900,000 or more, this would be classified as a finance lease as well.

Since finance leases transfer benefits and risk to the lessee, they can significantly impact an organization’s debt capacity.

Sales-type lease

A sales-type lease is a subcategory of finance lease in which the net present value or fair market value of the asset is unequal to its cost. This lease classification is only relevant to lessors, as they have to record it as either a selling profit or selling loss.

Direct financing lease

A direct financing lease looks similar to a sales-type lease on the surface, but it operates more like a mortgage, where a portion of each loan payment goes toward interest and the lessor reports it as unearned income. Again, this classification is relevant to the lessor, but not the lessee. The lessee simply identifies it as a finance or capital lease.

Lease classification test

To determine whether to classify a lease as a finance or operating lease, lessees need to conduct a lease classification test, wherein they evaluate the cost of the total lease payments over its entire term against the value of the asset and evaluate the lease duration against the asset’s remaining economic life.

Types of leases

While all leases generally fall under the classifications of either finance or operating leases, depending on their duration, cost, and risk, there are also three main types of leases related to the type of asset and the manner in which payments are made.

Real estate leases

Real estate leases involve either leasing land or a building. These represent some of the most significant liabilities in an organization’s lease portfolio and one of the largest operating expenses. These leases are advantageous because lessees don’t bear the full risk of ownership, and at the end of the term, they can choose to renew the lease or move to another building that better meets their space utilization needs.

Equipment leases

Equipment leases are incredibly varied. Depending on the industry, a company might lease airplanes, forklifts, trucks, soda machines, copiers, tractors, or just about anything else they need for business operations. Since the economic life of equipment is relatively short, these types of leases are more likely to be classified as finance leases.[9] Similar to real estate leases, equipment leases make it much easier for companies to relocate or redirect capital, and it lowers the upfront costs of acquiring new locations.

Embedded leases

Embedded leases don’t pertain to specific types of assets, but rather the way the lease is structured in a contract. Embedded leases are harder to identify because it may appear that a company is not paying for a piece of equipment, but they are paying ongoing costs associated with its use directly to the owner and likely with a markup. Embedded leases ultimately come down to “do you own this asset?” and “are you contractually obligated to indirectly pay for the right to use it?”

Lease accounting standards

Your organization and the circumstances surrounding your leases determine which accounting standard you have to comply with. The three main lease accounting standards for US companies are ASC 842 (FASB), IFRS 16 (IASB), and GASB 87, each of which has slight variations and apply to different types of organizations. All of these standards strive for greater financial transparency to simplify the evaluation of an organization’s level of risk and increase the utility of financial reports.

FASB ASC 842

With ASC 842, the Financial Accounting Standards Board (FASB) has introduced one of the largest shifts in US lease accounting in recent years. Now, leases lasting longer than 12 months must all be reported on the balance sheet, regardless of whether the organization owns or receives profits from the asset, and regardless of whether the organization is a public or private company.

IFRS 16

Similarly, IFRS 16, the latest International Financial Reporting Standard (IFRS) from the International Accounting Standards Board (IASB), “requires a lessee to recognize assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value” (IFRS). While lessors still need to classify leases into finance or operating leases, lessees only need to use a single accounting model.

GASB 87

The Government Accounting Standards Board (GASB) issued statement 87 in 2017 to provide this same level of transparency and accounting consistency to government entities, “requiring recognition of certain lease assets and liabilities for leases that previously were classified as operating leases and recognized as inflows of resources or outflows of resources based on the payment provisions of the contract. It establishes a single model for lease accounting based on the foundational principle that leases are financings of the right to use an underlying asset” (GASB).

Challenges of lease accounting

Lease accounting is a crucial process. It’s also full of pitfalls that can cost your organization dearly. Some of the greatest challenges include the scale of work required for large lease portfolios, the complexity of leases, creating and following lease schedules, and adjusting to changes over time.

Scale

Some enterprises have tens of thousands of locations, each of which could have numerous leases to account for. And each lease comes with a mountain of paperwork to wade through. Simply identifying your leases can feel overwhelming. For large corporations, the sheer scale of their portfolios makes lease accounting extremely difficult. Even with an entire team or department managing your lease portfolio, there’s an unwieldy amount of information to manage, track, analyze, and report on.

With upwards of 40,000 leases to account for, classification tests and incorporating leases into financial reports becomes a time-intensive process, and there’s ample opportunity for human errors to cost you money or cause compliance issues. An organization could miss an embedded lease obscured in a complex clause and thereby misrepresent their liabilities and level of risk. Or they could misevaluate the present value of your lease payments in relation to an asset’s value, resulting in a misclassification.

Thankfully, modern solutions can streamline the repetitive, time-consuming, and error-prone aspects of lease accounting. Lease accounting software like Tango Lease helps track every term and every clause to identify leases, key dates, and all the raw information your lease administrators need to keep you in compliance.

Complexity

Every lease is different. While every company is trying to solve the same problem—provide complete financial transparency—applying it to your unique lease portfolio can get incredibly complex. Circumstances like subleases, Common Area Maintenance (CAM) clauses, and co-tenancy clauses add additional layers of complexity and responsibility to the lease accounting process. The terms of each lease can significantly change how it’s classified, which standards it’s subject to, how much risk you’ve taken on, and what compliance entails.

Scheduling

Each lease in your portfolio has its own schedule for payments, renewal windows, and other key clauses. Creating and managing each schedule requires access to information that’s often buried in the terms of the lease. Lease administrators need clear visibility into these schedules in order to make accurate assessments of a lease’s current impact on your company’s financial commitments and debt capacity.

Tango Lease’s Critical Dates feature makes lease schedules a breeze. Our software automatically compiles important dates from each lease and helps calculate your payment schedule.

Change over time

Leases are inherently dynamic. Every time you renew or modify a lease, that change needs to be reflected in your lease portfolio. If you’re adding five years to a contract or renegotiating rent costs, that can alter your lease schedule, change key dates, and could even change how a lease is classified and reported on. The last thing you want in an already complex lease portfolio are plans and reports based on outdated leases. But every time a change takes place, you’ll need to consider how this change impacts your lease accounting for the year and make sure your team has visibility into when the change took place and any relevant aspects of the contract you changed.

Simplify lease accounting with Tango

Tango Lease is a complete lease accounting solution. Tango Lease automatically organizes the information your administrators need and conducts lease accounting calculations. Our software makes compliance with ASC 842, IFRS 16, and GASB 87 a breeze.

With Tango Lease, your lease department can save hours on tedious processes and reclaim that time for the problems and opportunities that truly require their expertise.

Want to see Tango Lease for yourself?

Schedule a demo.