As retailers seek out growth opportunities, void analysis often plays a key role in identifying prime trade areas. You don’t want to make a multi-million dollar investment in a new location only to discover that the market doesn’t have room for a business like yours. Void analysis helps you avoid that mistake.

Retail void analysis is the process of evaluating the concentration of businesses in similar markets to identify unsatisfied demand for your industry. It’s similar to white space analysis, but with greater emphasis on geographic areas, and it quantifies the difference in business concentration between markets.

For example: if you’re a fast food restaurant, you might compare City A, where you have one or more successful locations, to City B, where you’d like to add one. Perhaps City B would be an ideal extension of your supply chain, or you suspect it’s a good fit for your location strategy. Using City A as a benchmark, you project what it would look like for City B to have a similar concentration of fast-food restaurants based on demographic data and competitor locations.

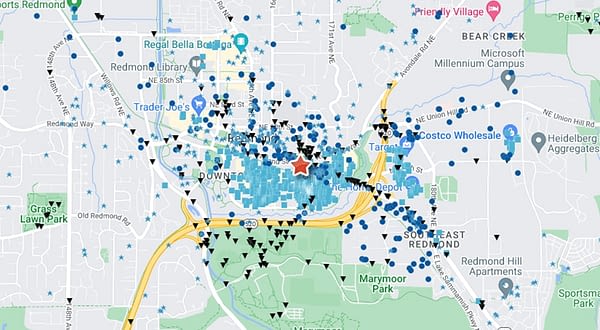

It’s not as simple as finding an open space on the map—you want to find a site that’s surrounded by the right people (your customers) and not already saturated with retail businesses like yours. So as a tool store, you’d want to find trade areas with the densest concentration of demographics that most closely reflect your best customers, and the thinnest concentration of competing tool stores.

The premise is simple, but the process can get pretty complex. Generally, retail void analysis gives you a rough idea of where gaps exist and how large they are, which can help you focus your site selection process. It’s for finding market-level opportunities, not specific locations. For example, you may find that a city has 20 fewer coffee shops than a comparable market where you have a successful stand, indicating that there’s likely room for you to open one there—you’ll just have to analyze individual trade areas and dig deeper to find the right site.

In this article, we’ll explain how retail void analysis works, how to isolate and compare true “voids” in a trade area, and some common mistakes retailers and analysts make.

How to do retail void analysis

Retail void analysis compares one market to another. So to find a “void,” you have to narrow down what you’re comparing, then refine your analysis. The exact steps will vary depending on the GIS mapping capabilities and data your site selection software has available, but here’s how it generally works.

Start with the city you want to use as a benchmark

First and foremost, you need to give yourself a frame of reference. Let’s say you have a successful store in Seattle, Washington, but the market is too saturated to open another location there. So you want to see how much room other cities have for businesses like yours before they reach Seattle-like market maturity. Seattle is your benchmark, and the difference between Seattle and the other cities you compare will be the “void.”

Isolate the demographics that matter to your comparison

To get an accurate comparison between your benchmark (Seattle) and other cities, you’ll want to pull out the demographic data that’s most relevant to your business. This step becomes more crucial and effective when you know more about your current customers—otherwise, you’re basing your analysis on intuition and personal experience, which may not be a reliable foundation for your comparisons.

Depending on your business, you may have a wealth of information about your customers, or you may need to rely on third-party surveys and analysis. Advanced site selection software like Tango Predictive Analytics can also help with this. When you don’t know enough about your current customers, Tango can use geofencing and mobile data to collect anonymized demographic information about the people who visit your stores. In this case, for example, you’d create a geofence around your Seattle location(s) to narrow down the Seattle demographics that visit your store(s) the most.

Once you’ve gathered some shared qualities of your customers, you can apply those demographics across the city. You may want to isolate the percentage of the population that falls under specific demographics, household incomes, professions, genders, etc. With some tools, you may also be able to isolate a population’s spending habits, such as how much they spend on groceries, consumer electronics, or health and wellness, allowing you to analyze the broad market opportunities within a city.

Select the city (or cities) you’d like to compare

After you’ve selected your benchmark and the population characteristics you want to compare, you need to decide on the city or cities where you’re looking for a retail void. In our Seattle example, it may be the largest nearby cities, like Tacoma, Vancouver, Bellevue, Kent, and Everett. Or perhaps you’re looking to expand to the other side of the state, crossing over to Spokane. Maybe you want to compare an out-of-state market, like Portland, Oregon, which is closer in population size.

If you don’t already have specific cities in mind, software with GIS capabilities can help you filter cities by characteristics and find something comparable. The cities don’t have to be close in size geographically or population-wise. You’ll adjust for these variables later. The important thing is to end up with cities where you’d consider opening a location, whether you started with specific cities in mind or used tools to generate a list.

Choose business categories to compare

With your cities identified, you can start defining the void you’d like to analyze. For this part of the process, you can use broad industry categories to classify the various kinds of businesses in each city. It’s worth noting though, some of your competitors may not fit neatly into these categories.

For example, if you’re a paint store, you wouldn’t just want a raw count of dedicated paint stores in each city—you’d also want to include stores with a paint department. Depending on your industry, big box stores may represent competitors even without departments dedicated to your niche. If they have an aisle full of products like yours, you will be competing against them. Since these competitors aren’t all the same, it can help to keep them in their respective business categories.

The goal is to generate a raw count of businesses your store would potentially compete with in the market. You can decide how generous you want to be with categorizing businesses as “competitors,” but the important thing is to apply your methods consistently.

The end result should give you a raw number of businesses that meet your criteria in the benchmark city and the comparison cities. A column highlighting the difference between them will give you the raw “void” number, with a positive number indicating that a comparison city has a void for that type of business, and a negative number indicating that it doesn’t (the void is actually in the benchmark city).

For example, suppose you’re a fast food brand, and City A, where you have a successful location, has 20 diners, 10 drive-thrus, and 20 food trucks. This initial comparison step of your void analysis might give you a table that looks like this for each comparison city:

City B

| Business Type | Number of Locations | Void (Compared to City A) |

| Diners | 17 | +3 |

| Drive-thrus | 15 | -5 |

| Food trucks | 12 | -2 |

| Total | 34 | –4 |

Here, the raw counts appear to show a void in the number of diners, but not in the overall number of competitors, suggesting that the market in City B is more saturated than the market in City A. However, these numbers still have to be adjusted to correct for other variables between the two cities. We don’t know if there’s a void in this retail market yet.

Additionally, some void analyses will zero in on individual businesses, looking at whether your competitors in City A also have a presence in City B, and compare the distance between their nearest locations.

Normalize your results

When cities don’t have similar population sizes, household numbers, or geographic areas, that doesn’t mean you can’t examine a potential void between them. You simply need to normalize the results to account for these variables. Using your benchmark city, you want to calculate the number of businesses per person, per household, and/or per square mile. Applying these ratios to the population, number of households, or geographic area of your comparison cities will give you the expected number of businesses for that city.

Essentially, this process is saying, “If City B had the same number of businesses in this category per [unit] as City A, it would have [number] businesses.” Then you compare the actual count of businesses per person, household, or square mile to the “expected” number (the adjusted results). And that’s your actual void.

So in the example we used in the table above, let’s say City A had a population of 20,000. That gives us a ratio of 0.001 diners per person, 0.0005 drive-thrus per person, and 0.001 food trucks per person. Now suppose City B has a population of 30,000. We’ll apply the ratios from City A to the population of City B to get out “expected” results and assess the void.

City B

| Business Type | Number of Locations | Expected Locations (Adjusted for Population) | Void |

| Diners | 17 | 30 | -13 |

| Drive-thrus | 15 | 15 | 0 |

| Food trucks | 12 | 30 | -18 |

| Total | 44 | 75 | -31 |

While the raw figures appeared to show that there wasn’t a void for any of these business types in City B, adjusting for population showed that the market could likely support significantly more diners and food trucks. Repeating this process to adjust for the number of households or square miles will help you understand more about the differences and potential voids between these markets.

Keep in mind: this will be most valuable when you isolate your ideal demographic. Using raw population data is helpful, but you may wind up with very different conclusions when you focus your analysis on the most relevant segment of the population.

Once you’ve finished your void analysis, you’re ready to begin the next phase of validating your ideas and prioritizing opportunities: trade area analysis and site selection.

Next steps after retail void analysis

Finding market-level opportunities is just the beginning. In fact, market-level analysis won’t necessarily even tell you which markets represent the best opportunities! As you work through your list and examine the trade areas and potential sites within them, you may discover prime locations in “lower priority” markets that can better capitalize on demand than the options in your top-tier markets.

Retail void analysis is valuable for gauging where to focus your more detailed real estate assessments. But from there, you’ll need more advanced tools, capabilities, and processes to create accurate site models, forecast sales, and choose the best locations.

For that, you’ll need a robust predictive analytics solution like Tango Predictive Analytics. Tango combines GIS mapping capabilities with mobile data and comprehensive site selection criteria, empowering you to make real estate decisions you can trust.

Want to see what Tango Predictive Analytics can do for you?

Request a demo today.