Everyone that spends capital begins with making a case for the resources they need to deliver on their part of the growth plan. Their primary goal is to first get what they need and then to execute their programs within budget. The role and goal of most of the departments involved in real estate and store development that require capital is generally clear and understood:

- Real Estate agonizes over how much they need to get the right sites.

- Construction studies past projects to estimate and control costs.

- Maintenance tries to balance between planned and unplanned projects.

However, one group that is often overlooked is Financial Planning. They too have a goal –to balance capital planning with spending. They have to walk a fine line between supporting company goals and not violating financial covenants.

And, in their caution, they often make the conservative assumption that nearly all appropriated amounts are spent in their Plan Year. Further, because plans may take a while to get approved, all activity may wait until funds are released, making it a mad dash to finish projects by year end. Ironically, this cautious approach can be the source of erratic spending.

Let’s examine this a bit further, and explore some ways to bridge this disconnect that exists between the people that plan capital use and the people who implement it to ensure the effective management of your entire development program.

A day late means a dollar short …

Ideally, capital planning and spending should be closely aligned, and to do that, it’s very important to get an early start. When you’re slow out of the gates, you rush to finish projects by year end, and can find yourself competing for the same resources with other companies.

There are many factors that can cause these delays – including how contingency amounts are managed. Savvy CMs include contingency amounts in their estimates to save themselves the trouble of “unnecessary” re-approvals. The issue here is that capital budgeting is based on planned spending. Teams don’t get unused contingency back to use until they close the project. This can create late starts in projects that happen later in the year as their funds are tied up in contingencies of earlier projects.

Even if projects are completed at an even rate, the natural billing and payment cycle will mean that significant portions of work completed in the fourth quarter will be paid the next year. You also can’t count on timely billing of work done; I’ve had vendors that billed more than a year after the job was complete. By the time companies realize they will materially underspend, it is frequently too late to accelerate next year projects. The result is some projects scheduled for the next year risk getting bumped to make room for late spending of current year budgets.

Bridging the Gap

How do we bridge this disconnect between those that plan capital and those that implement it? Let me share some methods that have worked before.

- Forecast New Stores by Ownership Type – Ownership type mix changes drive significant changes to capital needs, with fee stores costing many times a Build-to-Suit (BTS). Luckily, most development cycles are long enough that much of this can be forecast from your deal pipeline within your IWMS, with assumptions for goals beyond current inventory.

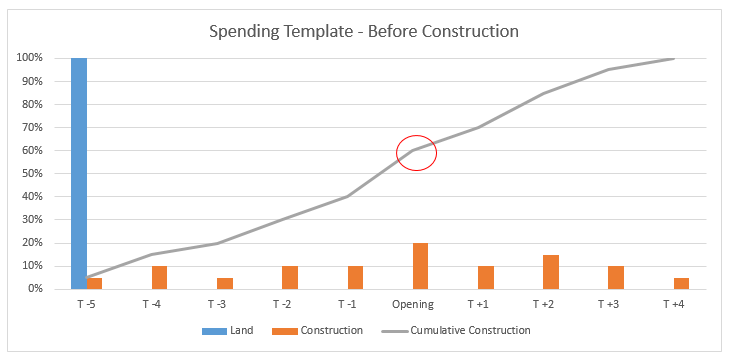

- Forecast Construction Spending – Create templates of spending by project type. For fee stores, you might forecast land purchases separate from construction since this is material and must happen well before construction start. Because so much attention is on opening or remodel dates, focus on that and project the pattern of spending around that date.

a. Example: Before project start

Here I estimated planned spending by month (“T-1” is the month before opening) for a new store, which was naturally driven by the development calendar. Note that in this example, only 60% of the construction money is expected to be spent by the opening month. Projecting across all projects, I knew how much spending should naturally fall into the following year. Planning can release more funds because they are able to estimate current year need with better confidence.

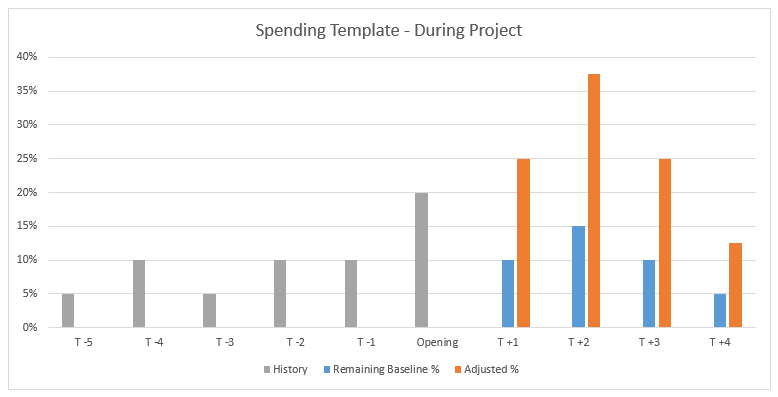

b. Once the project starts, I took the amount actually spent and subtracted it from the total. I then spread the unspent amount pro rata on the remaining planned percentages.

In this example, 10% of the total amount was planned to be spent in the month after opening; however, it is 25% of the remaining amount. Any amounts not paid once past the template horizon were forecast to be spent the next month. In doing this, the template could continue to serve my forecast, even during the project, and spending was always forecast to equal project budget.

c. Contingency amounts: All projects included a prudent contingency amount. Once a project has closed, the effective budget should be set equal to the actual spent so further projections stopped. Users were incentivized to close out projects as soon as possible by restoring any unused funds to their available budget.

In order to reconcile capital planning to spending, your Integrated Workplace Management System (IWMS) solution should track three totals: Prior Year, Current Year and Next Year spending (the “Year” is the planning/allocation year). Tracking these amounts will be confusing at first, but having the detail of each amount will ensure quick mastery by the team. It also reinforces the point that the project isn’t complete until everyone is paid. Prompt project closure will also allow timely booking of the assets, making your accountants and auditors happy.

One final trick: if the total budget is waiting final approval, you might ask for early release of funds for permitting some of your projects. These amounts are typically not material to the company health, but very important to the program timeline.

Know what you need and getting it done early…

By knowing in advance how much capital you need to spend this year, you may be able to release more projects than previously thought. By showing you need a lesser amount in the current year (backed by evidence) you can sometimes get projects released early (I said “sometimes”).

Lastly, tracking spending can reveal opportunities where project schedules allow early release of future projects to replace delayed earnings improvements. While not as detrimental as poor investment decisions, missed benefits due to inadequate tracking are sometimes visible in reported results.

While you’ve relied on your IWMS to enable you to execute each project faster, you can now leverage it to help you manage whole development programs more effectively.If you’re interested in learning more, download Tango’s Program & Project Management Datasheet below.