Tango Transactions

You need a solution that is flexible and has all the tools required to come out ahead. Balance the art with the science of the deal using the industry’s only comprehensive transaction management solution. Take a portfolio view of your locations, to evaluate, plan, examine new market opportunities and the impact of competitive moves.

Manage More

Internal resource, external partner, in the field, in the office creating a single team and a seamless experience. It’s not just about new deals. Manage all real estate transaction types, from new sites to renewals, terminations, relocations, renegotiations, and even closures – in a single solution.

Negotiate Better

Bring in information from across the location lifecycle by incorporating real estate strategy, lease and maintenance data, and all landlord communications to power your negotiations.

See the Future

Leverage predictive modelling to determine optimal location strategies and forecast site performance.

Get There First

Close deals faster and beat your competition to the best locations by streamlining, standardizing, and tracking activities in real time.

Key Features

Scenario Development

Determine the potential impact of transactions on the entire portfolio before committing resources.

Site/Property Analysis

Target new sites and dynamically assess their fit across multiple critical aspects to ensure alignment with real estate objectives.

Innovative Data

Incorporate traditional and advanced data sets to bring a new level of understanding to your deals. Data is power.

Mapping

Visualize and analyze markets and sites with the industry's only purpose-built online GIS platform with feature-rich capabilities.

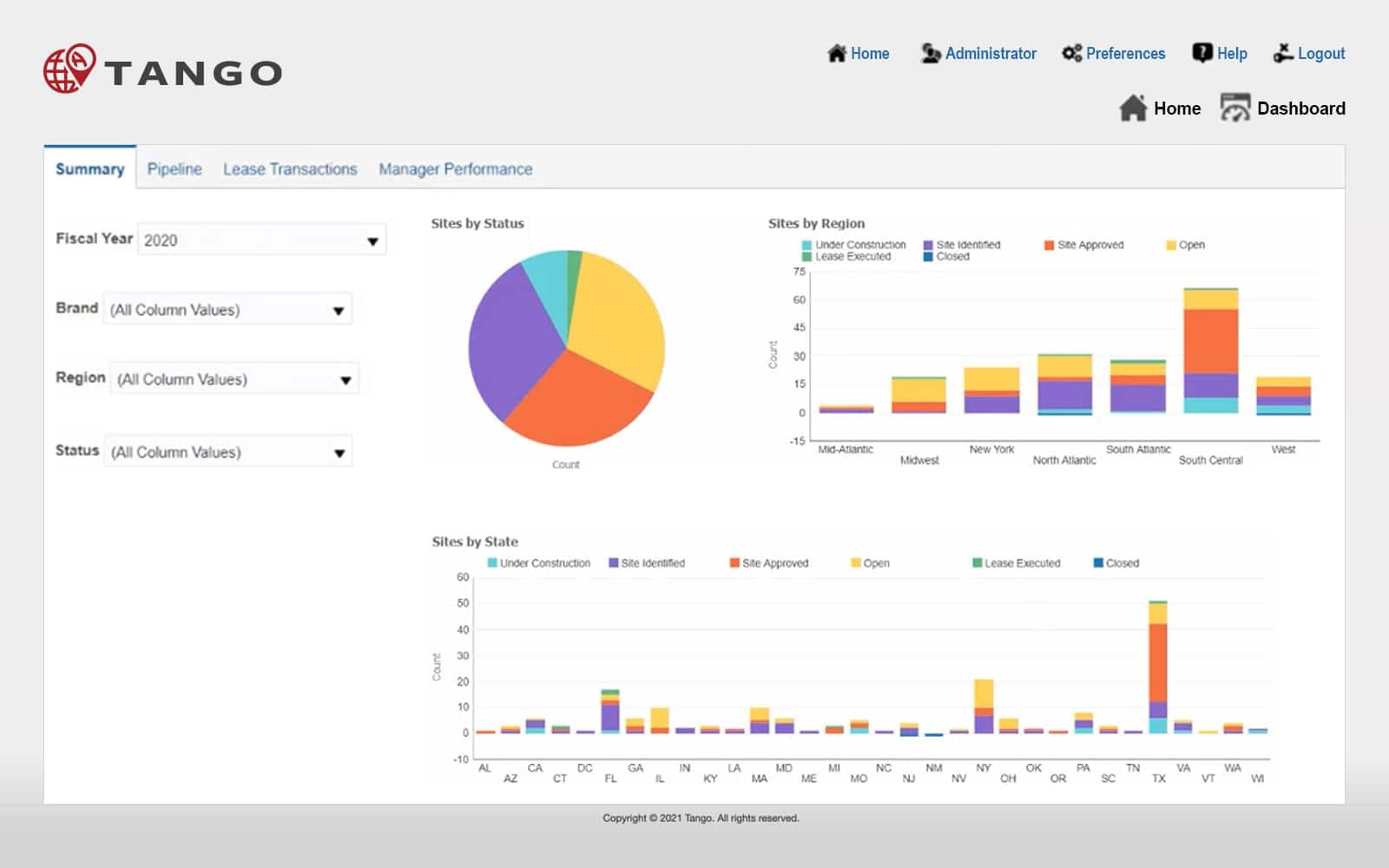

Pipeline Management

See your entire real estate pipeline clearly through maps, dashboards, and reports.

Budgeting

Incorporate the best estimates to make the smartest investment decisions.

Sales Forecasting

Site features tell the story of a potential location and provide data needed to power accurate sales forecasts.

Proforma

Eliminate mistakes and seamlessly incorporate proforma analysis into all transactions with a purpose-built configurable tool that fits all investment methodologies.

Transaction Packages & Deal Approvals

Create transaction packages at the click of a button with a single system that manages all transaction data and documents.